Starting a business is always a risky move. Doing so during a recession can seem like a bad omen to some, but there are some benefits to jumping into a risky economic climate.

Recessions can provide opportunities that didn’t previously exist, allowing your business to succeed in places that just weren’t available before. In case you didn’t already know, massive companies like Airbnb, Etsy, Whatsapp and Microsoft all started in a recession.

Although a recession is ripe with opportunities, there are also greater risks, especially around funding.

To help you weigh up whether an economic downturn is a right time (or not!) to start the business you’ve been thinking of, we’re here to list the pros and cons of starting a business during a recession.

The advantages of starting a business during a recession

For some people, there’s no better time to start a business than during a recession. This is especially true if you’ve had to be laid off from your normal role or find yourself with more time on your hands at home as the prices for going out skyrocketed. Every cloud has a silver lining, after all.

Let’s start with good news and dive into some of the pros of starting a business during a recession.

1. You’ll make better and smarter decisions about money

Budgeting and managing your finances is a key part of running a successful business. And if you start during a recession, this will be of extra importance to get right – which could give you a little bit of financial savvy over those that have started before.

What’s more, you might be able to snag some bargains on equipment or leases as demand decreases. That means more savings for you, and a better way to protect your cash flow.

Depending on the industry that you’re in, you could also bag some second-hand bargains from those who have to shut shop. It’s a bit of a morbid outlook, but their loss will be your gain.

EXCLUSIVE OFFERS – Save On Your Accountancy Costs

2. There’s a greater pool of talent

With increased layoffs and salary cuts, there’ll be a far greater pool of talent ready and available for the picking. If you’re looking to build a team, a recession will give you a great choice over some of the best candidates available.

Moreover, with few jobs available, you’ll also get applications from those who might not ordinarily consider a start-up.

3. You can build where demand is

Businesses fail during a recession when their usual revenue streams dry up, and they aren’t agile enough to adapt and find new demand and income streams.

By starting in a recession, you’ll have a greater insight into which avenues are worth pursuing – and the flexibility to build and adapt your business plan to chase these opportunities fresh.

Observations from Srinivasan et al. (2011) highlighted that B2C goods and services firms underspent on research and development during the recession. Cutting back on new products may sound wise but, in this case, those who chose to invest in R&D more were rewarded with increased profits.

Aside from this, SME responses to the 2008-2009 economic crisis show that developing new products and expanding clientele proved to be the most effective way of overcoming the recession (Kitching et al., 2011).

Which Company Formation Package Is Right For You?

Answer 5 multiple choice questions to get a personal recommendation:

4. You can outprice big competitors

Price is key – especially during a recession. As more prominent companies and more established competitors in the market have to deal with bigger overheads, they don’t have room to lower prices during a recession.

As a small start-up, you can easily price your product or service underneath theirs, gaining customers and building your reputation. It’s a great way to make an entrance to a market.

5. The competition is less fierce

Starting a business during a recession is a risky move, meaning that you’ll have fewer fellow competitors to worry about as you set up.

By being brave enough to start your business, you’re already outperforming those that daren’t enter the game.

A study on English SMEs’ response to the recession revealed that more than half of those surveyed attracted new customers despite the economic downturn (Price et al., 2013).

6. There’s a greater chance of government grants or help

During a recession, the government will often initiate schemes to help businesses start out, as this will, in turn, help improve the economy. That means that if you start your business during a recession, you might actually have access to different types of funding or grants that wouldn’t otherwise be available to you.

Starting A UK Business?

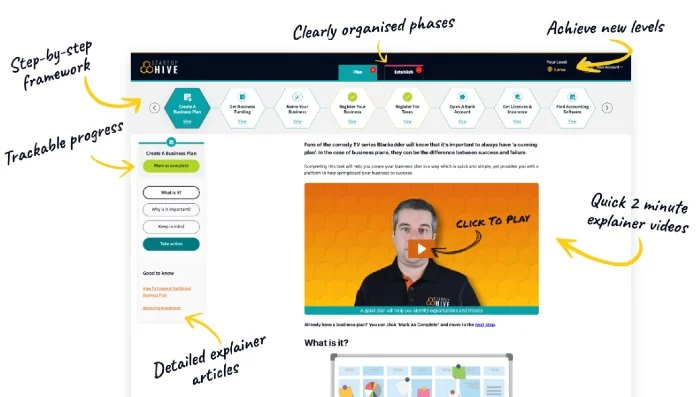

Get rid of the confusion and always know what to do next with Startup Hive, the step-by-step platform created by the Business4Beginners team.

- FREE Step-By-Step Platform

- FREE Bank Account

- FREE Bookkeeping Software

- FREE Email Platform

- FREE Domain Name

- Discounted Company Formation

- Plus Much, Much More!

Join today for 100% FREE access to the entire Plan & Establish phases, taking you from validating your business idea through to setting it up, getting your accounts sorted, and creating a website.

“Excellent guide to build your business”

“The perfect starting point”

“Incredibly simple and intuitive to use”

Startup Hive is your trusted companion as you look to turn all of your business dreams into reality. Join today for free.

—

7. There’s no right time, anyway

Did you know that 1 in 5 new businesses fail every year in the UK, regardless of whether they are in a recession or not?

Obviously, there are more risks and careful planning that need to go into starting a business during a recession. But there’s never going to be a risk-free time. No matter when you start a business, there’s always that chance it won’t work out.

If there’s no perfect time to start a business, then why not start it during a recession?

The disadvantages of starting a business during a recession

Now we’ve gone through some of the pros of starting a business during a recession, we need to balance it by reminding you of the risks involved.

Only with a full, balanced view can you make the decision about whether this is the right time or not to launch your business.

1. There’s less funding available

Times are tough all over, so getting the initial startup funding amounts you need might be tougher to get a hold of.

Compared to larger firms that can rely on direct credit and corporate bonds, smaller firms like yours have limited sources of financing, often only through intermediaries like banks (Sahin et al., 2011).

Unfortunately, at the height of the Great Recession, lending volume in the fourth quarter of 2008 was down by 47% than the preceding quarter (Ivasina & Scharfstein, 2009).

As companies all over tighten their belts, you might find that they’re less likely to take a chance on your company and instead opt for those they consider to be ‘safe bets’.

Adversely, you might find that the only options are to take out loans with higher interest rates than you might like, which could put you at risk of getting into debt or tricky financial situations.

2. Customers have less income to spend

Customers have less money during a recession, and as such, they are less likely to make impulsive decisions, buy luxury items or take chances on brands they don’t trust.

To win over customers, your business will have to work extra hard on attracting customers and earning their trust to get them to invest in your product or service. For some industries, it might be worth waiting until consumers have more disposable income to launch.

3. It’s harder to build an audience

Marketing your business and product relies on building a connection with your audience. But with consumers more conservative with their money and pulling back from spending, it will be harder to form relationships with your target audience.

Plus, as you’ll be working with a tighter budget, you might not want to spend the money on paid advertising methods.

This means you’ll be limited in which avenues you use, such as social media or building website traffic through SEO. These online marketing methods can be rewarding and fruitful, but they tend to take a longer time and more work to see the return over paid advertising.

What businesses do well in a recession?

There’s no such thing as a recession-proof business. All businesses need careful planning, strategy and luck to survive.

However, some businesses are more likely to thrive in recessions. These are namely businesses that provide services that are universally needed no matter what the economic climate is. For example, this could include:

- Health care services that offer treatments or preventative care, such as pharmacies or even gyms.

- Grocery-related businesses, such as convenience stores or food distribution in places far away from large chain grocery stores. Not only is food essential, but people will generally go out to restaurants for food less and need more home-cooked meals as they try to save money.

- Tax and accounting services, especially as people try to get a better hold on their own finances.

- Childcare services, as the need for parents to work during a recession, will become more urgent.

- Car mechanics or maintenance. People will still need to use vehicles for every day and their jobs, and there will always be a need for repairs, maintenance, and even cleaning. Similarly, plumbing or other repair trades will also be in demand.

- Hardware/DIY stores. As people have less income to spend on tradespeople, many people will take standard repairs and home improvements into their own hands.

- Tech and IT support. A lot of business is done online, which means there’s always a need for IT and tech support. During a recession, more people may start an online business or use old computers or tech to search for work, increasing the demand for these services.

These are just a few examples, but they aren’t the only businesses that do well during recessions.

Generally speaking, if you provide a service or a product that people will use every day no matter what their current income is, or something that people will need more as times are tough, you’re onto a winner.

How to start your business during the recession

If you’ve decided to go for it, there are just a few steps left to start your business.

1. Make a business plan

Firstly, you’ll want to make a business plan. This is where you outline who your business is, what you do, how your business works and what makes you stand out from the rest. It’s also where you can explore your market, customers and competitors – creating achievable goals to help your business succeed.

If you need to apply for funding, this document will be required by your potential investors. Find out exactly what you need to include and how to write a business plan in our in-depth guide here.

Once done, your business plan will be the guide to help you achieve your goals and make your way through the recession.

2. Pick your company structure

When starting a business, the legal ‘red tape’ part is determined by which company structure you opt for. Generally speaking, there are two main types that a start-up will use:

- A sole trader is most commonly used by one-person businesses. In this case, you are an extension of your business, which means that any profits or debt you acquire is fully in your name.

- A limited company is a fully incorporated company. This means that it classes as its own legal entity, giving you some protection as any debts or profits it makes belong to the business.

There are pros and cons to both company structures – but if you’re unsure, it might be best to set up as a sole trader and then change into a limited company later down the line when you start making more profit. Find out more in our guide on when to go from a sole trader to a limited company.

3. Form your company

How you form your company will depend on the company structure that you’ve selected.

If you opt to be a sole trader, all you need to do is register for self-assessment tax through the HMRC. And, of course, make sure you fill out your self-assessment tax forms each year. If you’re unsure about what tax you’ll be eligible for, read our guide on how to pay tax as a sole trader.

If you want to form a limited company, this process is a little more complicated. Instead, you’ll need to:

- Name your business – that isn’t already in use, too similar to existing companies or contains any offensive words.

- Make sure you have a UK address to use as your registered office.

- Appoint directors and assign shares. If it’s just you at the moment, then you’ll just need to assign yourself as a director and assign 100% of the shares to yourself.

- Create your official documents, including a memorandum of association.

- Complete the application form and pay the application charge.

Or, if you want to skip the hard work and red tape, you can turn to a company formation agent to take care of the entire process for you.

Top-Rated Company Formation Agents

| Formation Agent | Cheapest Package | Add On Services | Our Rating | Review | Official Site |

|---|---|---|---|---|---|

| £52.99 | Excellent | 9.4 | Read Review | Visit Website |

| £50 | Average | 9.4 | Read Review | Visit Website |

| £52.99 | Excellent | 9.3 | Read Review | Visit Website |

4. Run your business

Once these steps are complete, all that’s left to do is run your business and reap the rewards of all your hard work.

All the business advice and tips are at your fingertips

Whether you’ve decided to take the plunge and start your business during a recession or hold off until things start to look up, we’re ready to help.

At Business4Beginners, we’ve got all the tips, guides, and advice you need on starting and running a small business – as well as reviews from the leading company formation agents, accounting software and website builders to get you up, running and thriving.