![]() Rated #1 Best UK Online Accountant

Rated #1 Best UK Online Accountant

PROS:

- Low fixed monthly fee helps spread costs throughout the year

- No minimum terms, you can cancel whenever you like

- Unlimited advice from a qualified accountant based in the UK

CONS:

- There are a few negative customer reviews (though they are massively outweighed by positive ones)

- Can sometimes be difficult to contact

A big part of owning a business or being self-employed is keeping your books in order. This can be quite a scary prospect, especially if you are new to these things.

And it doesn’t matter if you are a freelancer, sole trader or limited company, bookkeeping is vital to ensure you have an overview of your financial situation.

Employing your own accountant and bookkeeper might not be possible for you, especially if you have only just started out. But don’t worry, you can outsource this work to an accountancy company.

In this The Accountancy Partnership review we will look at the pros and cons of this company, so you can make an informed decision on whether this is the right accountancy company for you.

At A Glance

The Accountancy Partnership offers you packages according to the type of business you have. This means you pay for the services you need in your circumstances.

With every package you will have access to Pandle, their own bookkeeping software.

We like this as it means you won’t have to pay for any additional accounting software. That said, it’s worth noting if you’re already using a different software, you can continue to do so. They’ll work with any setup.

You will get your own dedicated accountant who you can contact whenever you need them.

This is great as they are also based in the UK so are fully up to speed with proper regulations to give you the best advice.

What Features Does The Accountancy Partnership Offer?

As part of our The Accountancy Partnership review, we drilled down into the features that you will get when you use them.

This will help you to make a decision when choosing the right accountancy company for you.

Packages

For our The Accountancy Partnership review, we have looked at the packages in more detail. With each package you receive the following basic services.

Personal Accountant

When you sign up, you get assigned a dedicated accountant who will be based in one of their UK offices. You get unlimited access to your personal accountant, and they offer communication via phone, email, video call or in person.

Having a personal accountant with whom you can build a relationship and who knows your business will help to build trust.

Pandle

They have created their own bookkeeping software, which you can use as part of every package. However, their accountants are also able to use other bookkeeping software if you prefer.

Pandle is a simple bookkeeping software, similar to other ones out there. All your transactions from your bank accounts and credit cards will automatically appear in Pandle, where it will categorise and confirm them. You can also easily assign the right tax code to each transaction to make your tax return easy-peasy.

It also allows your customers to pay via a payment link, which means you get your money faster, as you won’t have to wait for a bank transfer.

You won’t have to keep your receipts in a shoebox any more, because you can just scan them and attach them to your transactions. That way, you have all your records in one place. You can also create invoices which you can send directly to your customers and Pandle will even chase them if they are late.

VAT is automatically calculated, and you can submit it directly to HMRC, so you don’t need to worry about non-compliance. We love this feature as it’s something not all accounting software offers.

And if you need to check your accounts when you are on the go, you can use the handy app.

Remember, while you have free access to Pandle, you can use any bookkeeping software you like.

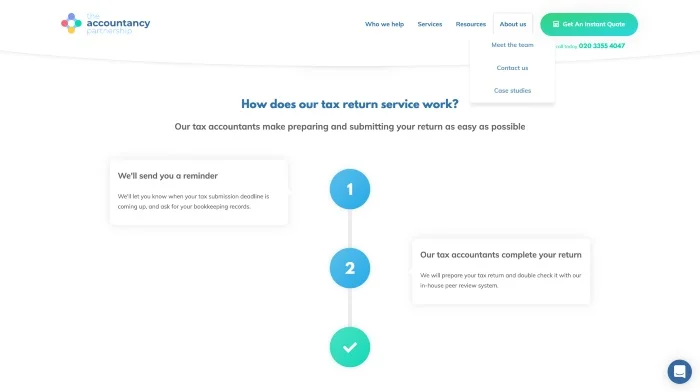

Completion Of Accounts And Tax Return

For companies, contractors and small businesses, your dedicated accountant at The Accountancy Partnership will compile your accounts and submit them to Companies House and HMRC. So you don’t need to worry about deadlines.

You will get a request from them to submit your records to them, and they will do the rest. All you have to do is check their work, lean back and relax.

They will also complete your tax return. Depending on your business type, this could be your self assessment tax return, your corporation tax return or your partnership tax return. And throughout the year, your personal accountant will offer you help and advice on all tax matters.

And should you ever get investigated by the HMRC, The Accountancy Partnership will provide representation for you.

Regular Deadline Reminders

To make sure that you never miss any deadlines and have to pay late fees, you will receive regular automated deadline reminders. These will help you to keep on top of your tasks and have peace of mind.

Make sure you check your spam folder though to avoid missing them.

Tax efficiency reviews

Your accountant will undertake regular tax efficiency reviews to make sure that you are only paying the taxes you have to. They will also make business recommendations, within their remit, to help your business to stay in tiptop financial condition.

This is important as it shows they aren’t just bookkeepers. A good accountant will look at your specific situation and tailor their advice to help you save money. We’re pleased to see that the Accountancy Partnership perform well in this area.

Company Registration Service

With the package for limited companies, you also get their free limited company registration service. They will register your company with Companies House and take out the hassle for you. You will receive all the documents you need.

This is great for startups who have a business idea but have not yet formed a company.

Add-on Services

For most simple businesses, this will be all you need. But if you have a more complex situation, you can add extra services at a cost. These are the paid add-ons you can get:

VAT Return

For a monthly fee, your accountant will also complete your VAT returns on a quarterly basis. They are fully Making Tax Digital (MTD) compliant, so you can have peace of mind.

Your personal accountant will also review your VAT returns on a regular basis to ensure you only pay the VAT you have to.

It’s simple, they will let you know when your next VAT return is due and ask your for your bookkeeping record. Then they will do the rest.

Bookkeeping

As a business owner or freelancer you don’t always have time to keep your own books. So, for a fee (charged per transaction), you will get your dedicated bookkeeper, who will ensure that your books are up-to-date.

All you need to do is send them your documents, and they do the rest. No more tedious bookkeeping entry after the other.

They will use any bookkeeping software you want.

Payroll

If you have employees, then you can add on the payroll service, where you get assigned a dedicated payroll clerk. This service is charged per payslip.

This service includes the production of all employee payroll documentation, dealing with HMRC on your behalf and filing all RTI returns. You will also get automated reminders to make sure you won’t miss a payroll deadline. Happy employees, happy business!

CIS Return

If you are a contractor working in the construction industry and need to do CIS returns, then you can add this service for a fee per statement.

Your accountant will produce your CIS returns and all necessary CIS documents. This means you don’t have to worry about it.

Fees

For our The Accountancy Partnership review, we have looked at their fees. They offer packages for different business types, which are tailored to fit the needs of each business:

- Sole trader

- Limited Company (Ltd)

- Partnerships

- Limited Liability Partnerships (LLP)

- Contractors

- Startups

They charge a monthly fee, which is low compared to other providers. However, you will have to fill in the form to get an accurate quote with details of your business and the service level you require.

This means you only have to pay for the basics in your package, so you won’t waste money on services you don’t need. But you can still get them if you do need them.

We think this is great for new business owners and startups, because at the beginning, your accountancy service requirements will be relatively simple.

Once your needs get more complex, you can add relevant services as you need them. This means they are an accuntancy service that can grow with your business.

You are also free to leave whenever you want, as you won’t be locked into a long contract. This can be useful when your circumstances change.

Resources & Support

As part of our The Accountancy Partnership review, we have also looked at any resources and support they offer.

On their website, they provide you with short videos about all kinds of tasks that are associated with bookkeeping, accountancy and running your own business. For example, there is a two-minute video about how to pay yourself.

You can find a wide range of short videos that will explain in an easy-to-understand way anything from what dividends are to corporation tax for limited companies.

They also provide short guides on a variety of topics, including about working from home, director’s loans, starting a business, etc.

Additionally, to these informative guides and videos, they provide you with downloadable templates, that can make your life much easier. For example, a template for a sales invoice or directors minutes and dividend vouchers.

They also publish regular blogs on their website about various topics. You can filter them by different categories, for example sole trader, to get the most relevant blog posts for you.

All these resources are available for free on their website and are very useful for newbies to the business world, but also for more experienced business owners who want to know a bit more about certain topics.

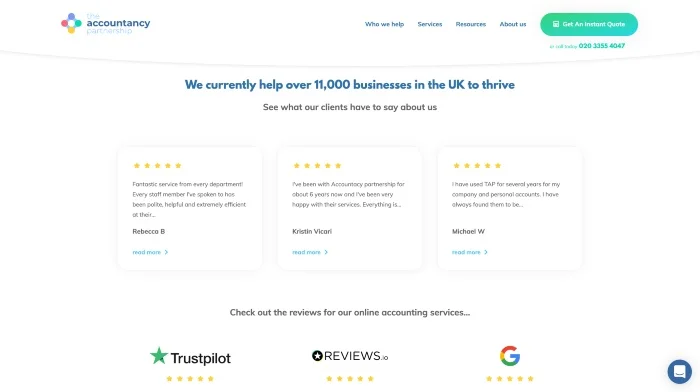

The Accountancy Partnership Reviews From Customers:

As part of our The Accountancy Partnership review, we also looked at the customer reviews to find out what the people who are using their services have to say.

On Trustpilot, The Accountancy Partnership have an excellent 4.7/5 rating, with 92% of customers giving them a 5 star view and less than 4% of customers leaving reviews of 3 stars or below. On Google, they also have a 4.7/5 rating, with glowing 5 star reviews from customers who praise the level of support and advice that they have received.

The Accountancy Partnership also have a 4.8/5 star rating on Reviews.io, with 97% of customers saying they recommend the company.

Clear, helpful and totally worth it!

I signed up to The Accountancy Partnership as I was a new small business owner and was in way over my head when it came to my accounts.

5-Star review from Limsan via Trustpilot

Mark (my assigned accountant) was really patient and explained everything clearly, which really helps when you are not particularly well-versed in this world!

The Accountancy Partnership made my plunge into starting my own business a much more comforting and enjoyable experience. Not having to worry about my accounts and having the security that my designated accountant was handling everything was invaluable. I would recommend anyone starting up in business who doesn’t have a huge deal of knowledge in this area to use The Accountancy Partnership.

5-Star review from Josh Candy via Reviews.io

Gabby and the team at the Accountancy Partnership help me every step of the way with managing my money. From sending out invoices using pandle software, to making sure my expenses are categorised correctly to cacluating and filing my annnual tax return. This has massively reduced my anxiety around managing money and makes me feel much more confident and in control of my finances. Thanks Gabby and team!

5-Star review from Charlotte via Google

Although the reviews are overwhelmingly positive, the few negative ones do mention having issues with slow communication, particularly during busy periods like when year end accounting is due. No matter what service you use, we’d like to use this as a good reminder not to leave all your accounting until the last minute.

The Accountancy Partnership TV Advert:

The Accountancy Partnership Review – Conclusion

Our The Accountancy Partnership review has concluded that this provider offers a wide range of online accountancy services at a low fee. They also give you the personal touch by assigning you a dedicated accountant for your business.

You have unlimited access to your personal accountant, who will be on hand to provide you with help, support and advice to grow your business.

Their packages are tailored to your business type and include the basic accountancy services you will need. If you have more complex needs, you can add on more services (at a cost) to meet these.

Their bookkeeping software, Pandle provides you with an easy-to-use tool to keep your books in order. But they won’t make you use it, they are happy to work with any bookkeeping software you prefer.

With the wide range of resources they offer to their customers, they ensure that you have all the knowledge you need to make your business successful and thrive in what you do.

Overall then, we have no hesitation in recommending The Accountancy Partnership.

Top-Rated Online Accountants:

| Accounting Software | Cheapest Package | Value For Money | Our Rating | Review | Official Site |

|---|---|---|---|---|---|

| £24.50/mo | Excellent | 9.4 | Read Review | Visit Website |

| £42/mo | Good | 9.3 | Read Review | Visit Website |

| Variable | Good | 9.1 | Read Review | Visit Website |