Your business is up and running; your website is online, and you have found the perfect niche market to start making money.

But then you realize you need to decide one more thing: how to deal with accounting and bookkeeping.

It was certainly one of the things I found daunting when I started my first business.

However, accurate bookkeeping will save you money and time in the long-run, so it’s best to tackle it properly from the beginning.

As the saying goes, death and taxes are inescapable, so let’s see what your options are and how you can manage your bookkeeping needs in a way that suits your business with our bookkeeping for beginners guide.

The Basics Of Bookkeeping

Your bookkeeping obligations vary according to the business set up you have chosen.

Basic Bookkeeping for Sole Traders

As far as keeping accounting records go, sole traders have it far easier than any type of company. In essence, all you need to do as a sole trader is keep records of all of your income and all of your expenses.

When it comes to doing your tax return, you can just add these up and enter the figures in the appropriate place on the form.

This means that using a simple profit and loss account and retaining copies of all invoices and receipts (so you can show the tax man should you ever get asked to prove your tax returns are accurate).

It’s a good idea to set up a filing system and number your invoices and receipts so that you can easily track and record them. Your profit and loss account can be a simple spreadsheet detailing income and expenditure.

It’s also a good idea to break down income and expenditure into categories such as advertising costs, banking fees, etc. This will then help you better manage your business and cashflow.

As sole traders do not need to file any accounts, this is all you really need to do in terms of basic bookkeeping and a lot of it is just to make your life easier in the long-run.

When I first started out in business I was a sole trader and I employed very basic bookkeeping to keep a track of everything. Firstly, I used a bank account that only had my business transactions (no personal transactions) as this helped keep everything simple and in one place.

Then, each month I’d maintain a simple spreadsheet detailing my main income and expenditure totals. I found it useful to set a reminder in my calendar to do this once per month.

I also had a folder on my computer and a box folder to store any receipts and invoices. These were only kept in case the tax man ever needed to see ‘proof’ of my claimed income and expenditure. That never happened, but it was good practice and gave me peace of mind.

Recommended – Top-Rated Online Accountant:

Basic Bookkeeping for Limited Companies

Unfortunately things are not quite as straight-forward for limited companies as you will need to deal with a more complex set of circumstances such as dividends and PAYE as well as file annual accounts with Companies House.

It is also a legal requirement that you stay on top of your company’s accounting records and keep historical records for at least 6 years.

I keep several box folders on my shelf with my accounting records going back for 6 or so years. I also retain digital records of everything from the start of my business.

The main things you will need to maintain a basic set of accounts are:

- Sales Ledger – detailing all income and amounts still owed

- Purchase Ledger – detailing all expenditure

- Wages Book – Showing all salary payments and National Insurance contributions

From these you will be able to prepare your annual accounts, which is a legal requirement for all limited companies.

Lost the buzz for your business?

Starting a business is exciting. Succeeding is rewarding. The bit between is hard, repetitive, and full of self-doubt.

The Lonely Middle Club (From Business4Beginners) helps you through it:

Get support and advice from other small business owners

Remove the self-doubt that’s holding your business back

Learn techniques and strategies to grow your business faster

Be inspired with our exclusive ‘swipe’ file and AI-powered tools

No pressure – work at YOUR pace, towards YOUR goals

—

Generally, your basic bookkeeping responsibilities in the UK involve the following:

- Keeping track of income and expenses. This involves receipts for expenses you have made and invoices for work that has been delivered.

- You need to file a self-assessment income tax based on your income from your business.

- If you are VAT-registered, you need to complete VAT returns and payments on a quarterly basis.

- If you have employees, you need to calculate income tax and national insurance for your personnel. This is a system called PAYE (Pay As You Earn).

Because of the complex nature of preparing accounts, you would generally be advised to use an accountant or bookkeeper to prepare your accounts. Not only will this ensure that all records are accurate but it can also help to save you money in the way of tax efficiency.

It will also save you a lot of time and headaches so that you can concentrate your time on making your business a success.

I have certainly found my accountant to be a knight in shining armour when it comes to trying to understand my tax situation and ensuring I comply with all filing regulations.

Accountants and bookkeepers can charge anything from a couple of hundred pounds to several thousand pounds for annual accounts to be prepared. You can see the average accountancy costs for limited companies here.

Typically, I pay my accountant around £600 a year (works out to be about £50 a month), though I have relatively straightforward accounts and use accounting software which helps bring the cost down. Your accounting bill may be more or less than this depending on your circumstances.

For most companies just starting out, the price will be low and then gradually rise as your business grows, and your transactions become more complex and numerous. I started out paying only £200 or so but it’s gradually increased each year.

Keep in mind that even if you do outsource the preparation of your accounts to an accountant or bookkeeper, you will still need to do some basic bookkeeping yourself.

As with a sole trader, you will need to keep and file away all invoices and receipts and keep a basic profit and loss account in order to track all of the incoming and outgoings of your business.

Doing this will help to save you money on your accountancy bill as it will make the preparation of your accounts much quicker and easier.

Bookkeeping, The Simple Way

You can record your bookkeeping manually. Manual bookkeeping is probably best suited for very small businesses with few transactions.

All you need is a few file folders and binders, plus an organising system to keep records of your income (payments, cheques, bank transfers, etc.) and expenses (bills, purchases, receipts, credit card payments, etc.). Keep track of all dates when your customers or clients paid you and also keep copies of your bank statements.

This is pretty much the method I used when I first started in business and was acting as a sole trader.

Manual bookkeeping may not be an automated process, but it is a perfectly legal way to keep a record of your income and expenses.

It’s the way our fathers and forefathers did it. While not particularly elegant or effective, it works and has done so for many years.

However, it’s slow and needs you to be pretty good with numbers and detail-oriented. Otherwise, mistakes can be costly, especially if your company is audited. That was one of the main reasons I chose to employ an accountant at an early stage – for peace of mind I wasn’t doing anything wrong!

Bookkeeping, The Effective Way

If manual bookkeeping sounds like something from the past century, you can choose to subscribe to an accounting software programme. Several accountancy software packages cater to various business needs and requirements.

Accountancy software packages save time, money, and effort by helping you record all your transactions.

I’ve been using accounting software for many years now and I absolutely love it! It makes everything so much easier and simpler and is well worth the cost. Bookkeeping for beginners would be so much harder without.

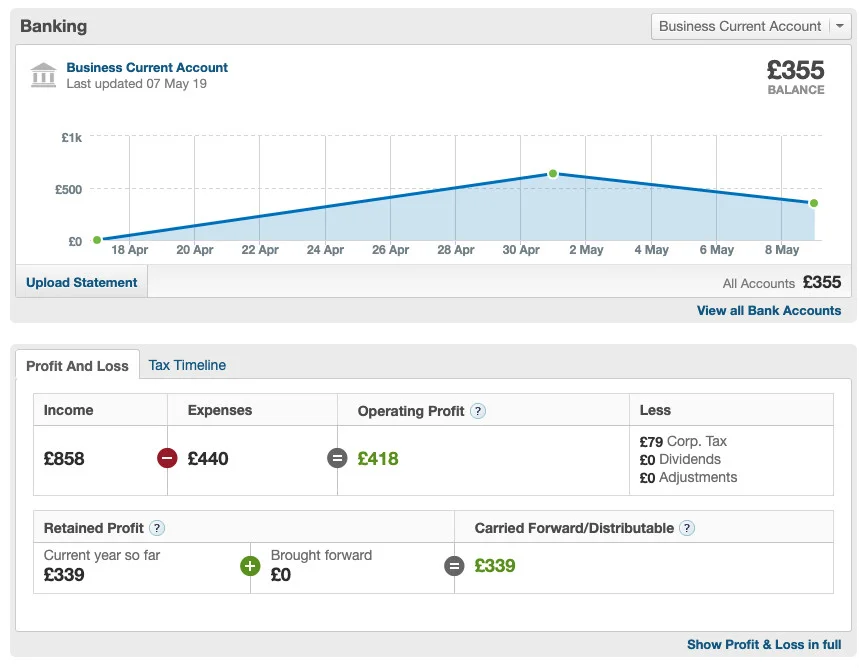

The best accountancy software will automatically calculate your profits, asset depreciation, PAYE, national insurance, corporation tax, VAT, self-assessment income tax, and many other financial requirements. All you need is to be diligent about entering the right amounts.

Accounting software covers most basic accounting requirements, including:

Keeping track of income and expenditure

This includes invoices, purchases, bills, cheque payments, automatic billing, and recurring payments (think subscriptions). It will also categorise expenses according to their type (for instance, utilities or advertising).

One feature I really love of FreeAgent is the automatic bank feeds that pull your transactions into the software. It saves so much time and means you just have to focus on explaining transactions and attaching invoices and receipts to each one.

I also find the reports really useful. At a glance I’m able to see how profitable our business is and what our cashflow looks like. I’ve used this mean times to get an overview of current performance.

Our Recommended Accounting Software:

| Accounting Software | Cheapest Package | Ease Of Use | Our Rating | Review | Official Site |

|---|---|---|---|---|---|

| £33/mo | Excellent | 9.4 | Read Review | Visit Website |

| FREE | Outstanding | 9.3 | Read Review | Visit Website |

| £16/mo | Excellent | 9.3 | Read Review | Visit Website |

Preparing your records for taxation

Your accounting software will produce all necessary reports in a way that facilitates submission to the tax authorities.

I usually submit Payroll and complete my self-assessment tax returns directly in the FreeAgent software. While it can also create Corporation Tax returns, I usually let our accountant deal with those for peace of mind they are correct.

Calculating depreciation of assets

Machinery and fixed assets like furniture and computers have an expected life of several years. Accounting laws usually depreciate their value over three to five years.

Accountancy software will do that for you automatically, without you having to worry about making an error in an equation or using the wrong coefficient.

Calculating inventory

Anything that you have in stock should be part of your inventory, or you may be liable for it. This is a particularly valuable service if you are selling physical goods and need to be sure that what you have in physical stock is accurately represented on paper.

It will also help you spot any problems within your organisation such as inventory going missing.

Taking care of salaries, payment and payroll

By preparing all necessary paperwork for PAYE, accountancy software can both save you a lot of time and ensure fewer mistakes. Mistakes which can potentially be pretty costly!

As I mentioned, I always run and report Payroll via FreeAgent. I can easily go in and check past payments and how much is due, plus the software uses the amounts to automatically populate my self-assessment tax return with the figures.

Filing bank reconciliation details

Bank reconciliation is when your business account is matched to your bank statement. Bank reconciliation makes sure that there are no wide inconsistencies between these two. Again, accountancy software can be quite the time-saver in this.

This is the feature I mentioned earlier that I really value. Every few months I have to re-authenticate the connection, however it’s minimal effort considering the amount of time it saves me.

Costs Of Accountancy Software

Accountancy software packages offer different options, according to your accounting needs.

Prices start at just £6 per month + VAT for a basic accounting package. An average price covering more accounting features needed for a small business could range between £15 and £40 per month. More advanced packages providing for large firms’ needs cost hundreds of pounds.

For me, I’ve found this is a small price to pay for the benefits it provides my business. For one, it saves money on my accountant bills as it makes everything well-organised for him. I’d guess I save much more on his fees than I spend on FreeAgent fees!

When choosing a software package, read carefully about any limitations and extra costs that are not covered by the subscription fee. Think about package upgrades, number of users covered by your licence, and how many transactions your licence pays for.

Which Accounting Software Is Right For You?

Answer 5 multiple choice questions to get a personal recommendation:

Also, consider the time it will take your business to learn the new software package. Lastly, remember to ask what your options are in case of troubleshooting or if you need support.

Bookkeeping, The “Mind-At-Ease” Way

If you don’t feel confident to do your bookkeeping yourself, either manually or with the help of accountancy software, you can always hire a bookkeeper or an accountant to do that for you.

You will need to look around and check for prices. However, price is not the only consideration. Bookkeeping and accounting is a serious business, and you should feel assured that the bookkeeper you have chosen is both trustworthy and has the required experience and knowledge.

Accurate bookkeeping is essential once you start your business: you could be audited by the government at some point, and you need to be confident that everything you are filing is meticulously recorded and precise.

Given the ease and cost of accounting software, I’ve never seriously considered a bookkeeper for my business. However, my wife does help me out with some basic bookkeeping tasks. We have an email account that I forward all receipts and expenses to. She then explains most of the transactions.

This works well for us as it keeps my bookkeeping tasks to a minimum, though I’ll still generate invoices, run payroll, and check performance regularly.

Costs Of An Accountant

The price of an accountant varies according to your business requirements.

You can negotiate a monthly payment which will cover specific accounting tasks, including your tax returns. The cost varies but could well reach £100 per month for limited companies.

As I mentioned earlier, I’m currently paying around £50 a month but as my business grows, I’d expect that to rise further. The great thing about accountancy fees is that they typically only rise as your business grows!

Having an accountant on a monthly basis may seem expensive, but it means peace of mind: all you need to do is send your paperwork and everything will be taken care of. You won’t have to worry about your company’s accounts, and you know exactly how much it costs.

Alternatively, you can pay your accountant per hour. As for how much a bookkeeper charges per hour, prices start around £15 per hour. You could also pay your accountant according to the task.

For instance, you may choose to personally handle simple income-expenditure recording, but hire an accountant for PAYE or VAT. In this case, it is perhaps better to pay your accountant on a task-basis, with payroll fees reaching £50 per month.

My accountant charges me by the hour with the bulk of the fee taken up by preparing and submitting our annual accounts. He does, however, add on any extra charges needed if I’ve requested additional support or meetings from him during the year.

In any case, you can negotiate with a bookkeeper or an accountant depending on your needs and the amount of money you are willing to spend.

EXCLUSIVE OFFERS – Save On Your Accountancy Costs

Some Basic Bookkeeping Tips

We want to make the task as easy for you as possible, so our bookkeeping for beginners guide must include tricks and tips.

Whether you do your bookkeeping yourself or hire someone else to do it, here are a few useful tips:

Hold on to your receipts and invoices

HMRC requires you to keep them for up to 6 years. Keep them safely and securely for your own records as well, in case you have a disagreement with a client or a customer.

I keep digital records indefinitely and paper records for 6-8 years to be safe.

Do your job

Even if you don’t do your bookkeeping yourself, you will still need to do a minimum of filing. Invoicing your customers or clients and gathering all proof of your expenses is part of your job.

Number your invoices and receipts

This will make things easier to track down, especially if you do your bookkeeping yourself.

If you’re using accountant software like I do, the software will usually number everything for you automatically.

Photocopies can help with organisation

Although it is not exactly environmentally friendly, photocopying receipts and statements to put them in different filing categories could save you time in the future if you are looking for them.

However, I’ve found now that most accounting software let you snap a quick photo of a receipt and upload it instead. This is a perfectly acceptable way of storing receipts and invoices – digital copies are all that are required.

Put aside time to do your bookkeeping

It can be an hour per week or 10 minutes per day. Whatever way suits you best, reserve some time on a regular basis to do some basic bookkeeping.

This will both ensure your accounts’ accuracy and avoid having them snowball into an unmanageable heap by the year’s end. When it comes to accounting, procrastination is definitely not your friend.

Separate your personal banking from your business one

Open a business account which will only handle your business transactions. Use a business credit card and a business cheque book. This way your bank reconciliation will be easier and faster and you will never mix your personal finances with your business ones. It will also give you a clear idea of how your business is doing.

As I mentioned earlier, this was one of the first things I did when I started as a sole trader – I used a bank account for my business that had no personal transactions going through it whatsoever.

If you have a limited company, you’re required by law to have a bank account exclusively for it.

Keep track of cash payments

They can be easy to forget and a nightmare when it’s bank reconciliation time. Even if it is in manual format, register your cash payments.

If you use an accountant, send them all invoices the moment you issue them. This means you won’t have a massive list of unregistered invoices at the end of the financial year. And it also means that you will have reported all your income, thus avoiding being accused of tax evasion.

Which Is Best For You?

That depends on your business size, needs, and personal preferences. However, many small-business owners may find manual bookkeeping too tedious and hiring an accountant too expensive.

That’s why many opt for the middle path: accountancy software like FreeAgent (this is the software I use). This has the appeal of automatically covering your financial needs at a fraction of the cost of hiring an accountant while speeding up and simplifying your company’s bookkeeping.

Whichever path you follow, follow our tips so that you can focus on what your company does best: satisfying your clients!

Top-Rated Accounting Software:

| Accounting Software | Cheapest Package | Ease Of Use | Our Rating | Review | Official Site |

|---|---|---|---|---|---|

| £33/mo | Excellent | 9.4 | Read Review | Visit Website |

| FREE | Outstanding | 9.3 | Read Review | Visit Website |

| £16/mo | Excellent | 9.3 | Read Review | Visit Website |