Setting up your business as a Limited Company has a variety of benefits, including less personal risk, better financial backing, and bigger tax breaks with allowable expenses.

If you’re thinking about setting up a Limited Company, one aspect you need to understand is shares. Shares are a great way to earn investment or split the ownership of your business if you’re working alongside others.

We’ve created this complete guide to ensure you know everything about assigning shares in a limited company.

Limited company shares explained

A share, in a nutshell, is a piece of a company. Those who own one own a part of the business, and are thus entitled to some of the profits. It’s like your limited company is a cake, and the slices are shares. You can cut as many slices as you want and divide them as you wish (or keep the entire cake for yourself!). Everyone with a slice will own a piece of your cake.

Before we jump into the rest of the guide, it’s important that we outline a few terms that you’ll come across in this process.

Share capital is the total value of all your shares at the time they are issued. For example, if you issue 100 at £1 each, your total share capital would be £100. Share capital is the total face value of your shares – but might not be what they actually sell for.

Share premium on the other hand, is the value you do sell your shares at. So if you sell them at £1.50 each, this would be the share premium value.

A shareholder is a person that holds shares in your business. How many they hold will equate to how much ownership they have of your company. For example, if they own half the shares, they have half ownership of your limited company.

Shareholders typically have voting rights in shareholder meetings and earn dividends from your profits, but this depends on the type of shares that your company offer (covered below).

A director is a person that manages your business and runs it on a day-to-day basis. You can be a director and a shareholder of a company, which is a common practice for limited companies that are owned and run by one person.

How to assign shares in your limited company

Now we’ve clarified those key areas, it’s time to get into the step-by-step details of how to assign shares in your limited company.

1. Decide how many shares your company will have

First, you need to work out how many shares your business will have.

There’s no set rule on how many shares a company can have. If you’re planning to be the only director and shareholder, you could issue as little as one share that’s assigned to yourself.

On the flip side, there’s no limit to how many you can issue. But you have to be warned that the more shares you issue, the more costly it could be for stakeholders to invest as they’ll have to pay for each individual one.

Generally speaking, a lot of limited companies tend to opt for 100 shares – as it makes the ownership and commitment easy to calculate. How many shares a person has simply equates to their % ownership.

For example, Jimmy is setting up his new limited company Blue Ice Skis. He’s planning to run it with his two sisters, Kim and Marie, and wants to give them an equal part (but still keep the majority of shares himself). Jimmy decides to create 100 shares. Later, he will assign 60 shares to himself, 20 to Kim, and 20 to Marie.

This means that Jimmy has 60% ownership of the company, while Kim and Marie both have 20%.

Easy, huh?

2. Decide who gets shares in your company

Now you know how many shares of your company there are, you need to decide who you give them to.

Anyone can have shares in your company, as long as you both agree to the purchase. The one thing you can’t do as a private limited company is sell your shares on the stock exchange.

When deciding who gets shares, you need to consider if you want any shares in your own company. As a director you’re not required to have any shares. You could potentially run the business without owning any part of it, while the ownership is split amongst others. In most cases, small limited companies are majority-owned by the director.

When thinking about who gets a share of your company, it’s important to remember that by becoming a shareholder, this person will now own part of your company. However, this doesn’t mean that shareholders run your business or manage it on a day-to-day basis. The management will remain with you and any directors that you have appointed.

As a shareholder though, they do care about the success of your company. The more profit you make, the bigger dividends that they’ll earn, or the more they’ll be able to sell their shares for at a later date.

Shareholders will be interested at the very top level in how your business is performing and may put pressure on directors to go in a certain direction if they feel like it’s best for your company.

Shareholders also get a vote in company decisions (unless you opt for a no-vote share agreement), meaning that big decisions will have to be agreed on by your shareholders. Generally speaking, this will be the big picture thinking and decisions rather than small daily changes.

If you’re planning something big for your limited company, it’s always best to get your shareholders onboard and maintain a good relationship with them.

3. Agree on the number of shares for each individual

Deciding how many shares each person will get impacts the ownership, control, and future dividends of your company.

The more shares a person has, the greater ownership they have – and thus more voting rights when it comes to decision-making in the future. They’ll also have a greater share of profits through dividends and thus take a bigger reward when you do well.

When assigning the number of shares, you might want to consider factors like:

- How much the person is contributing to the initial capital. If everyone is contributing an equal amount, it might make sense to allocate and equal number of shares.

- How much involvement the person has, or will have, in your business. Those who are going to be more involved in the day-to-day running might want to have more voting rights and shares.

Let’s go back to our Blue Sky Skis example. Jimmy knows he wants to allocate 100 shares, and that it should be split between himself and his two sisters.

Although both Kim and Marie equally helped him set up the business, Marie has decided to help Jimmy with the day-to-day operations.

- Jimmy still wants majority ownership, so he allocates 55 shares to himself, owning 55% of the company.

- He rewards Marie with a greater share proportion than Kim, giving her more voting power in the future. She gets 25 shares, and owns 25% of the company.

- Kim gets the remaining 20 shares, and owns 20% of the company.

If you’re unsure how to allocate shares, it might be worth consulting with a solicitor or accountant for tailored advice about your specific circumstances.

4. Chose the type of shares

There are three main types of shares that a limited company can issue:

Ordinary shares

If you’re setting up a limited company, this will be the option that you are most likely to take.

Ordinary shares are like how they sound. They have no special preferences or caveats attached. Everyone that has a share of your company will have full rights to dividends, voting rights and entitlement to capital should the worst happen.

Preference shares

Preference shares are ones where shareholders are given a fixed right to dividends and aren’t allowed to vote. This is good for businesses who want to get outside capital, without having any external stakeholders interfere with the day-to-day running of the business.

It also works well for investors who want a steady return from company dividends, without having to devote any time to the business.

Alphabet shares

Alphabet shares are often used when shares are issued to employees of your limited company. This usually happens within bigger organisations as a staff perk and can be customised to give bigger rewards based on seniority or staff performance. If you’re the sole employee, this won’t be one for you to worry about yet.

Alphabet shares can each have different voting rights, entitlements to dividends, etc. That means companies will sometimes issue B, C, D (and so on) shares to gain more control over the way company rights are managed.

Other share types also exist, including:

- Cumulative preference shares, which means that unpaid dividends from one year can be carried on to the next by the shareholder.

- Non-voting shares, which give the shareholder dividends but take away their right to vote at general meetings.

- Redeemable shares, which are ones that the company will be able to ‘buy back’ at some point in the future, or in the case of an event such as leaving the company.

- Management shares, which carry more voting rights and have a stronger influence during meetings.

For a small limited company, we’d recommend using ordinary shares for now. But if you’re unsure or need further advice, speak to your accountant for full guidance based on your unique situation.

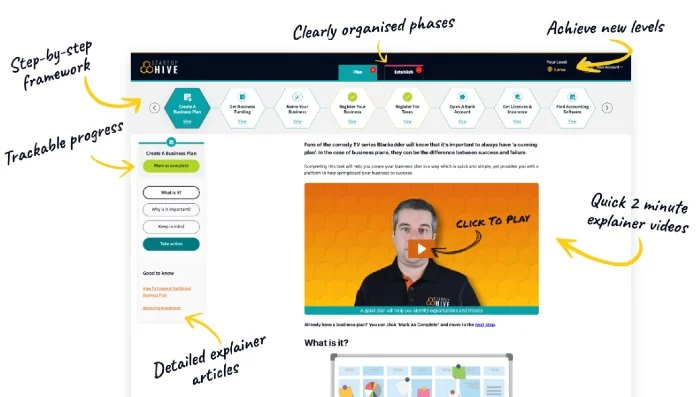

Starting A UK Business?

Get rid of the confusion and always know what to do next with Startup Hive, the step-by-step platform created by the Business4Beginners team.

- FREE Step-By-Step Platform

- FREE Bank Account

- FREE Bookkeeping Software

- FREE Email Platform

- FREE Domain Name

- Discounted Company Formation

- Plus Much, Much More!

Join today for 100% FREE access to the entire Plan & Establish phases, taking you from validating your business idea through to setting it up, getting your accounts sorted, and creating a website.

“Excellent guide to build your business”

“The perfect starting point”

“Incredibly simple and intuitive to use”

Startup Hive is your trusted companion as you look to turn all of your business dreams into reality. Join today for free.

—

5. Make it official during the formation process

Assigning shares in a limited company happens during the formation process. Once you’re ready, you will need to inform Companies House of:

- The number of shares that your company has

- Your share capital, which is the total value of your shares

- The names and addresses of all your shareholders

After this stage, any changes that you make will need to be recorded and sent to Companies House.

As well as listing the names and addresses of your shareholders, you also need to list information such as:

- What percentage of dividends they receive from your company profits

- Whether they can vote on company matters

- How many votes they get

When assigning shares in a limited company, it might be a good idea to create a shareholders agreement.

This isn’t a legal requirement but is a great idea for limited companies that are planning to have more than one shareholder.

A shareholders agreement is a binding contract that defines the rights and responsibilities of share members and directors, the way the business should be managed, and the decision-making process within the company.

This type of agreement helps protect both parties and avoid any conflict further down the line, especially if more shares are created.

Top-Rated Company Formation Agents

| Formation Agent | Cheapest Package | Add On Services | Our Rating | Review | Official Site |

|---|---|---|---|---|---|

| £52.99 | Excellent | 9.4 | Read Review | Visit Website |

| £50 | Average | 9.4 | Read Review | Visit Website |

| £52.99 | Excellent | 9.3 | Read Review | Visit Website |

Ready to form your limited company?

Now you know everything about assigning shares in a limited company, nothing is stopping you from registering your company.

If you don’t want to take care of the red tape and paperwork yourself, then a company formation agent will be the solution for you. These are companies that specialise in forming limited companies and will take care of all the paperwork on your behalf.

Find the company formation agent for you with our reviews of the best company formation agents here.

Top-Rated Company Formation Agents

| Formation Agent | Cheapest Package | Add On Services | Our Rating | Review | Official Site |

|---|---|---|---|---|---|

| £52.99 | Excellent | 9.4 | Read Review | Visit Website |

| £50 | Average | 9.4 | Read Review | Visit Website |

| £52.99 | Excellent | 9.3 | Read Review | Visit Website |