Creating your own business seems like a good idea. Just think of an idea, set it up and get to work.

Sadly, there are a few more steps involved in that process. One of which is choosing the type of UK company structure that your business is. With so many different options, this can seem like an overwhelming and complicated process.

That’s not to mention each type of UK company structure will come with its own regulations and rules that you need to adhere to. It’s even more complicated if you’re choosing between a typical business and a not-for-profit organisation like a charity. But, we’ll get to that later.

First, let’s go through the types of UK company structures built for-profit that you might want to register your business as.

The main types of UK company structures

If you’re running a for-profit, which means that you’re out to make money and take home a nice pay, then these are the types of UK company structures that you’ll need to choose from.

1. Sole Trader

A sole trader is a type of UK company structure most used by one-person businesses such as photographers, hairdressers, tradesmen and more. It’s perfect for those who are mostly going to be running the shop alone, as everything you make will belong to you. You just need to make sure that you fill out a self-assessment tax return every year.

Despite what the name implies, you can hire someone as a sole trader. You just need to make sure that you adhere to the rules and regulations of employing someone as a sole trader.

Setting up as a sole trader is relatively quick and easy. There’s no registering fees and very little red tape that you have to jump through to get up and running.

Although you’ll have full responsibility for your business, the downside to being a sole trader is that you’ll also have full responsibility for any debts you acquire as well. You can find out about all the legal obligations of being a sole trader here.

2. Partnerships

Partnerships are similar to a sole trader, except that there is more than one person involved in the business. This means that you’ll share responsibility for the company and any debts that it occurs.

Be careful about who you choose as a partner though. You won’t just be responsible for your own debt in a partnership but also the debts of your partner.

3. Limited Company (LTD)

Like a sole trader, a limited company is one of the most popular types of UK company structures when setting up a new business.

A limited company is an incorporated company, meaning it classes as its own legal entity.

This means that it can enter contracts and own property. And unlike a sole trader, any debts it acquires will be tethered to the company alone, not to the individual running it.

Important Note:

Companies House fees for new incorporations are increasing massively (by around 400%) on 1st May 2024. We recommend forming new companies before this date to avoid the price increase. All company formation agents are likely to increase their rates after this date.

Another benefit is that you pay tax on your corporation, rather than on your personal income. This also gives you the flexibility to claim for a number of allowable expenses, helping increase your profits.

5. Limited Liability Partnership (LLP)

A Limited Liability Partnership (LLP) is like a mixture of a partnership and a limited liability company. That means that they run the business and share responsibility, but get the added backup of limited liability that physically separates the company from their own individual assets.

Unlike a partnership, an LLP will also have to file annual accounts and submit a Compliance Statement to the Companies House every year. An LLP must also file a tax return but each individual member of the LLP partnership will pay tax on their own personal share instead.

An LLP is usually the UK company structure type used by accountants and lawyers, who want to operate as partners with the protection of limited liability.

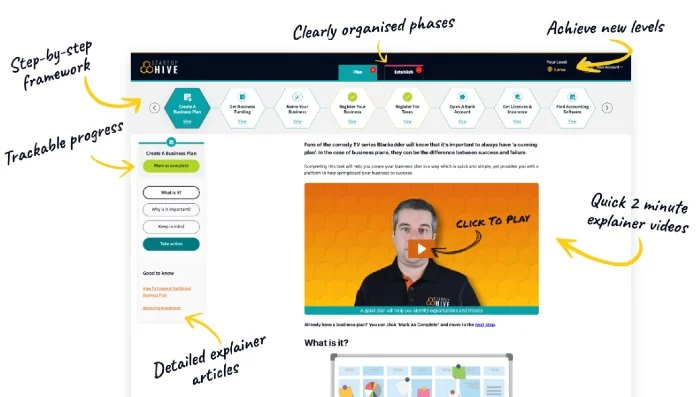

Starting A UK Business?

Get rid of the confusion and always know what to do next with Startup Hive, the step-by-step platform created by the Business4Beginners team.

- FREE Step-By-Step Platform

- FREE Company Formation

- FREE Bookkeeping Software

- FREE Bank Account

- FREE Domain Name

- FREE Email Platform

- Plus Much, Much More!

Join today for 100% FREE access to the entire Plan & Establish phases, taking you from validating your business idea through to setting it up, getting your accounts sorted, and creating a website.

“Excellent guide to build your business”

“The perfect starting point”

“Incredibly simple and intuitive to use”

Startup Hive is your trusted companion as you look to turn all of your business dreams into reality. Join today for free.

—

6. Public Limited Company (PLC)

A Public Limited Company is a limited company that can sell shares or debentures to the general public.

Generally, most new businesses don’t start out as a PLC. They are often companies that start as a limited, but then re-register as a PLC in order to sell shares and raise capital.

A PLC is required to have a share capital of over £50,000, 25% of which has to be paid up before it can begin trading. They must also have at least two directors and a company secretary, making it a big upfront investment to run.

Which Company Formation Package Is Right For You?

Answer 5 multiple choice questions to get a personal recommendation:

LTD vs Sole Trader

A sole trader is easier to set up than a limited company but also poses more financial risk as you’ll be personally responsible for any debts that you gain.

Generally, a limited company is great for those who are planning on hiring a team of people or have a business that isn’t based around your skills alone. For example, if you’re selling a product, you might want to register as a limited company instead of a sole trader.

A limited company will be taxed as a corporation, which means that if your annual income is over £40,000, you might find better tax relief than as a sole trader.

If your business is all about you, and your skills, whether you’re an electrician, a barber or an artist, then being a sole trader might suit you better. This will also give you greater control over the business and the decisions that are made, where a limited company may have shareholders or other people involved in the decision making process.

LTD vs PLC

A limited company and a public limited company are very similar in terms of how they are registered and run. The only difference is that a PLC can sell shares to the public, meaning that they can raise capital in a way that limited companies can not.

If you’re just starting out, a PLC requires a lot of upfront capital and other requirements that you have to hit in order to register. For nearly all cases, it’s best to register as an LTD and then re-register down the line as a PLC if that’s what you need.

What about not-for-profit organisations?

The not-for-profit organisation is a broad term given to all companies that aren’t run to make a profit. This includes charities, community groups and more. Basically, if you’re not making a private profit for directors, members or shareholders, your business will fit into this category.

The type of UK company structure for not-for-profits organisations depends on the following factors:

- How your organisation will be funded, for example, will you be run by donations or will you rely on income from selling goods and services, like highstreet charity stores?

- Whether your organisation will be controlled by voting members, or if it will be controlled by a small group of people who aren’t elected.

- Whether your organisation will be incorporated, which takes your organisation from a collection of individuals to a single entity.

- Whether you’re a charity, or just working in community interests.

Right, let’s get into the not-for-profit UK company structures out there, shall we?

1. Unincorporated association

An unincorporated association is an organisation of members that can carry out whatever activities the members decide on.

It’s the quickest and easiest not-for-profit UK company structure to set up because it doesn’t require you to make your business a legal entity.

In an unincorporated association, you are a group of individuals that carry your own legal responsibility. This means that you cannot hire staff or lease premises in a businesses name. If this organisation runs into any debts or financial issues, it will have to be taken out and solved on an individual basis.

To set up an unincorporated association, you just have to write and agree on a constitution among your members that dictate your businesses actions.

Unincorporated associations can also register as a charity, provided it complied with certain guidelines that we’ll outline below.

2. Charitable Trust

A charitable trust is a type of charity that is run by a small group of trustees. Trustees are members that are appointed into the role rather than elected by a wider membership.

Charitable trusts are not incorporated, which means it is not a legal entity that can enter contracts or own property in its own right.

To set up a charitable trust, you need to write and sign a trust deed, which provides that your organisation is legally charitable. This means you need to govern themselves in accordance with the Charities Act. Some of these regulations include:

- Not paying trustees in charge of the organisation;

- Keeping good records for their finances, charitable activities and trustees;

- Not taking part in political activities or campaigning.

If you have an income of over £5,000, you must also register with the Charity Commission.

3. Charitable Incorporated Organisation (CIO)

Introduced in 2013, a CIO (Charitable Incorporated Organisation) is a type of charity that is incorporated. This means that the charity is seen as a legal entity, and can therefore own property and enter into contracts.

There are two types of CIO:

- Association model CIOs, which have a large group of members that hold elections to appoint people into roles.

- Foundation model CIOs, which are run by a small group of appointed trustees.

To set up a CIO, you need to use a model constitution that is approved by the Charity Commission and apply online via their website. This process can take up to 40 days to complete.

Other charitable organisations can also convert into CIOs.

4. Company limited by guarantee

A company limited by guarantee is an incorporated company that doesn’t distribute income to its shareholders. This is one of the types of UK company structures that isn’t always used by not-for-profit organisations but can be used as a model if all profits are used to to be reinvested back into the organisation.

This type will be controlled by a group of directors, who can be paid. If you wanted to run a charitable organisation like a business with paid staff, this is the best type of UK company structure to use.

To set up a company limited by guarantee, you need to to register the organisation with the Companies House and submit a governing document called a Memorandum and Articles of Association.

5. Charitable Company

A charitable company is an incorporated company that is registered both with the Charity Commission and the Companies House. This means it must abide by the laws of the charities act and often will be made from unpaid directors.

Unlike a CIO, Charitable companies have to report to the Companies House and often face more regulations and fees to run.

6. Community Interest Company

A community interest company is a not-for-profit organisation that is not a charity. This means that it can serve the community, without having to adhere to all the regulations set out in the Charity Act. This type of UK company structure is most often used by social enterprises.

Community interest companies commit all assets and profits permanently to the community using an “asset lock”. It’s a way of ensuring that all profits go where they are intended. In addition, Community Interest Companies can also have paid directors.

To become a Community Interest Company, you need to apply to the CIC Regulator, which is a department inside the Companies House.

7. Community Benefit Society

Another of the types of UK structures is the community benefit society which is a company owned by members. Each member holds a share and controls it democratically, with every member receiving equal voting and treatment inside the society.

Like community interest companies, community benefit societies can apply for asset locks, which ensure that all assets and profits of the organisation are reinvested into the business or aiding the community.

A Community Benefit Society can register as a Charitable Community Benefit Society with the Financial Conduct Authority if it has:

- aims that are exclusively charitable; and

- a Statutory Asset Lock specifying that any assets would be transferred to another charity if the organisation wound up.

This type of UK company structure is also incorporated and can have paid directors.

8. Cooperative Society

A Cooperative Society is similar to a Community Benefit Society, but its main purpose is to provide services to its members rather than the wider community. In general, membership to a Cooperative Society is open to people who use the services provided by the society or work for the society.

These services must be based on co-operative values such as:

- Self-help;

- Self-responsibility;

- Democracy;

- Equality;

- Equity;

- Solidarity.

Because the purpose of this society is to help members, not the public, it can’t be classed as a charity.

A cooperative society can also have paid directors, and profits may be distributed to members providing this is not the primary purpose of the organisation.

Is a community group a UK company structure?

If you want to set up a community group to help others on a small budget or to set up something that you can volunteer to in your free time, you might not need to legally set up your community group as an official UK company.

This only works for small scale community groups that don’t employ staff or lease premises. If you’re just a group of individuals coming together to do good work, then you can have an unincorporated association.

As we pointed out before, an unincorporated association means that everyone inside the organisation is legally responsible for themselves. It’s a lot easier to set up and there’s less control over how your group is run. But if there’s any debts or finances to cover, they’ll come from you individually.

To set up a community group, just write and agree on a constitution between the members and get started.

Need more advice?

Why not check out these articles for further reading on the types of UK company structures:

- The top advantages of being a sole trader

- What are the legal obligations of a sole trader?

- Allowable expenses for a limited company that you can claim

- What are the average accountancy costs for a limited company?

Once you’ve decided on what to set your business as, we’ve even got a list of the best company formation agents to help set you going.

And don’t forget to download your free guide on the company formation process.

When it comes to running your own business, we’ve got all the advice, tips and news you’ll need at Business4Beginners.

Top-Rated Online Accountants:

| Accounting Software | Cheapest Package | Value For Money | Our Rating | Review | Official Site |

|---|---|---|---|---|---|

| £24.50/mo | Excellent | 9.4 | Read Review | Visit Website |

| £42/mo | Good | 9.3 | Read Review | Visit Website |

| Variable | Good | 9.1 | Read Review | Visit Website |