Starting a business is exciting, but it can also be confusing. One of the earliest decisions to make is what business structure you want to set up.

According to government statistics, at the start of 2023, 93% of all UK businesses were either sole traders or limited companies. So clearly these are the most popular business structures for budding entrepreneurs.

But which one to choose? In this article we will elucidate the difference between sole trader and limited company to help you make the right decision for your new venture.

At a glance: sole trader vs limited company

| Sole Trader | Limited Company | |

|---|---|---|

| Legal Status | You are your business | Your company is its own entity |

| Liability | Full | Limited |

| Tax | Income tax | Corporation tax |

| Set-up | Quick, easy, free | Slower, easy, fees |

| Regulations | Less | More |

| Running costs | Lower | Higher |

Difference in legal status

One of the biggest differences between being a sole trader and a limited company is the legal status. As a sole trader, you are the business, and you own and run it alone.

In contrast, a limited company is its own legal entity and can be owned and run by more than one person. Although it can be set up by one person who holds sole control.

The way a limited company is divided between different directors is by handing out shares. This isn’t possible for a sole trader business, as the business and the owner are one and the same thing. And as you can’t divide yourself into more than one person, your business can’t be divided either.

This difference in legal status has implications on several other things too.

Liability

Because as a sole trader you are the business, you are personally responsible for it, including debts and legal obligations. This means that if your business incurs debts, your personal assets will be used to pay them off.

In contrast, a limited company is a legal entity in its own right which is different from its directors and owners. So in case of debts, the personal assets of any director aren’t at risk.

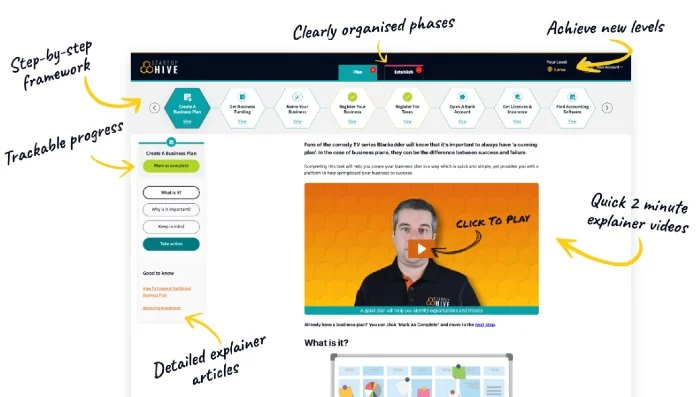

Starting A UK Business?

Get rid of the confusion and always know what to do next with Startup Hive, the step-by-step platform created by the Business4Beginners team.

- FREE Step-By-Step Platform

- FREE Bank Account

- FREE Bookkeeping Software

- FREE Email Platform

- FREE Domain Name

- Discounted Company Formation

- Plus Much, Much More!

Join today for 100% FREE access to the entire Plan & Establish phases, taking you from validating your business idea through to setting it up, getting your accounts sorted, and creating a website.

“Excellent guide to build your business”

“The perfect starting point”

“Incredibly simple and intuitive to use”

Startup Hive is your trusted companion as you look to turn all of your business dreams into reality. Join today for free.

—

Employment

While both sole traders and limited companies can hire staff, as a sole trader you can’t employ yourself. That’s because there is no difference between you and the business.

But if you own a limited company you can be its employee and enjoy all the benefits that come with this.

Any salaries will have to be paid through PAYE and you have to pay any relevant taxes, such as National Insurance.

Selling up

You have probably heard of these entrepreneurs that build up a business and then sell it for a good profit they can retire on. Well, this is only possible with a limited company.

When you are the business, then it can’t exist without you. So you won’t be able to sell it, as you can’t sell yourself.

But a limited company is its own legal entity that will continue to exist if you sell it own.

However, it should be said that it’s easy to change from a sole trader to a limited company. So if you are considering to one day sell up, you can still start out as a sole trader and switch later.

Difference in tax demands

The taxes you have to pay will also differ depending on which business structure you choose. The main difference is that a sole trader pays income tax on everything their business earns. This is done through a self-assessment tax return.

Even if you pay yourself a monthly salary, this doesn’t change anything. Because you are the business, any money you make from it is seen as your income, and you are taxed accordingly.

A limited company has to pay corporation tax on its profits. Then the directors have to pay income tax on any money they draw from the business. This means that if you own a limited company you have to do two tax returns: your corporation tax return and your self-assessment tax return.

However, running a limited company is more tax efficient, if only just. That’s because you only pay corporation tax on your profits, minus any running costs, including your own salary.

And you have the option of taking a wage from your company and a dividend. You can take a salary that is just below the threshold to pay income tax, to avoid having to pay it. Then you can take out the rest as a dividend, which is taxed at a lower rate.

You can find out more about how dividends work in the UK in our article about this topic.

As a sole trader, this option isn’t open to you. You have to pay income tax on anything you earn, minus any allowable expenses.

Allowable expenses

Both sole traders and limited companies can use allowable expenses to reduce their tax bill. However, there are different rules to follow for each, and generally speaking, limited companies get the better deal.

Both can only expense costs that are “wholly, exclusively, and necessary” for the business. While this might sound a bit vague, it basically means that you can only deduct expenses for things that are necessary for the running of the business.

As we have already mentioned, any salary or wage you pay yourself as a sole trader isn’t classed as an allowable expense. That’s because all money you make is classed as your income and is taxable.

But if you pay yourself a salary from your limited company via PAYE, this is classed as an allowable expense.

When you own a limited company, entertaining clients is an allowable expense up to a limit, and you have to tell HMRC about it. On the other hand, as a sole trader, this isn’t an option. Any entertainment for clients has to be paid by yourself and can’t be deducted from your tax bill.

If you want to know more about what you can deduct from your tax bill, read our articles about allowable expenses for sole traders and expensing as a limited company.

Apart from this, most expenses are similar for a sole trader and limited company.

Different regulations for sole traders and limited companies

Another difference between sole trader and limited company is the regulations each type has to adhere to. Here the sole trader has the upper hand, as there are fewer regulations to worry about.

Record keeping

One thing both a sole trader and limited company must do is keep accurate records of their business operations.

For a sole trader these business records include the following basic accounting records:

- Any money earned and spent

- If you are VAT registered, any records relating to VAT you charged

- If you employ staff, any PAYE records

- Any personal income

- Any relevant grants you have received by the government

- Bank statements

The type of proof you would keep are such as invoices you have issued, receipts for goods or services you bought and bank statements.

The records a limited company has to keep include all the above accounting records plus some more:

- Records about any assets the company owns

- About debts owed by the company or someone owes the company

- Information about stock and stock takings

- Records concerning goods bought and sold (and who they were sold to unless it’s a retail business)

But a limited company has to keep other types of records as well, including:

- Information about company directors, shareholders and secretary

- Records of shareholder votes and decisions made

- Documents regarding any promises made by the company in terms of loan repayments or indemnities

- Information about any loans or mortgages the company has taken out

- Records of shares being sold

- Information about “people with significant control” over the business

Basically, any relevant records about the company, its owners/directors and shareholders must be kept. But that’s not all for limited companies: there are more regulations to abide by…

Confiramtion statement

As a limited company, you also have to submit an annual Confirmation Statement to Companies House. It sounds more complicated than it is, really.

All it means is that you need to confirm the details of your company, such as office address, directors, shareholders, company secretary, etc. It’s a legal requirement, and you will be fined up to £5,000 if you fail to do it.

There is also a fee attached to filing your Confirmation Statement, which is £34 for online filing and £62 for postal filing. So this is a cost you have to pay once a year.

You are also legally obliged to tell Companies House about any changes to your business, some of which can be reported through the Confirmation Statement.

Other regulations for limited companies

There is more to think about for limited companies. Any business premises has to have a sign telling people that the company is operating here. This includes a head office as well as branches.

The only exception is if you’re operating your business from home. You don’t have to put up a sign in front of your house.

Any stationary and marketing material you use for your business has to include vital information about your company:

- Office address

- Registration number

- Where the company is registered (England and Wales, Scotland or Northern Ireland)

- That it’s a limited company

A sole trader doesn’t have to worry about any of this, but that doesn’t mean you don’t have any legal obligations as a sole trader. Depending on the type of business you run, you might have to have relevant insurances or licences.

Running Costs

Running a business, whether as a sole trader or limited company, involves regular costs. Generally, running a limited company is more expensive.

The main reason for this is that a limited company has more regulations to abide by and this means more paperwork, which in turn means higher costs.

The above extra regulations for limited companies are partly responsible for higher running costs. But costs for bookkeeping and accounting play the main part.

Accounts of a limited company can be much more complex than those of a sole trader. Most sole traders do their own bookkeeping and self-assessment tax return without the need to pay for professional help.

A good accounting software can make it even easier and quicker, without adding too many extra costs. And limited companies can also benefit from using such tools.

Here at Business4Beginners we use FreeAgent for our business accounts. And we use an accountant to check over our accounts and then submit them to HMRC. This gives us the peace of mind to know that we have filed accurate accounts.

However, depending on the size of a firm and the complexity of their accounts, it might be necessary to hire a bookkeeper and/or accountant. Or at least outsource these tasks to an industry professional.

This can increase running costs quite a bit. However, the fines for submitting inaccurate accounts can be even higher. So it’s worth investing in an accountant to at least give your accounts a once-over.

EXCLUSIVE OFFERS – Save On Your Accountancy Costs

Setting-up your business

Another big difference between the two business structures is the set-up and associated costs. You might have guessed it, a sole trader gets the better deal again.

Not only is it very quick and easy to set up as a sole trader, it’s also free. It can be accomplished in three simple steps.

First you have to tell HRMC that you are self-employed. This can be easily done by filling out an online form.

Then you have to decide under which name you want to trade. This can be your own name or a company name.

Finally, you have to register with HMRC for Self Assessment tax returns. That’s it: you are all set up and ready to go. Now you just have to make sure you file your Self Assessment tax return every year.

Setting up a limited company is more complex and involves fees, but it’s still relatively simple.

First you have to decide on a company name. You want to make sure that a company with this name doesn’t already exist. You can check if your preferred name is still available by entering it below.

The actual registration can be done by post or via the Companies House website. It’s a 7-step process, during which you will have to give certain information about yourself and the company you want to register, including:

- Company name

- Details of directors, shareholders and company secretary

- Details of people with significant control over the business

- How you will run the company

You also have to pay £50 for the registration. You will then get a “certification of incorporation” that is proof that you have a legally registered company.

You can register for Corporation Tax at the same time in most cases. But you can also do it later. However, it has to be done within 3 months of setting up your company.

As a limited company, you will also need a business bank account. Whereas as a sole trader you could use your private one, if you wanted.

Using a company formation agency

One thing you can do to make things a bit easier is to use a company formation agency to set up your limited company for you.

All you need to do is give them some information, and they will do the rest. They tend to have different packages, which offer different services.

While they will charge a fee for their services, most have a basic package that is only slightly more than the Companies House registration fee. So you don’t have to spend much more to get it all done for you.

We used a company formation agency (1st Formations) when we started our businesses and still use the same firm to manage our companies. In our opinion, it’s well worth investing a bit more money for the peace of mind that everything has been set up properly.

Which Company Formation Package Is Right For You?

Answer 5 multiple choice questions to get a personal recommendation:

Know the difference between sole trader and limited company

Choosing the right company structure is the first step to starting your own business. And it can feel a bit daunting, especially because there are upsides and downsides to both.

Hopefully, this article will have given you a good understanding of the difference between a sole trader and a limited company. Armed with this knowledge, you can make a decision that’s right for you.

Most people start out as a sole trader and then switch to a limited company when the business has grown. When to do this will depend on the circumstances of each individual business. But we have written a guide to give you an idea when it’s time to change from a sole trader to a limited company.

While it’s also possible to switch the other way round, this would involve dissolving your limited company and then register as a sole trader.

If you want more information about sole traders and limited companies, here are more articles you might find useful:

- All you need to know about running a small company from home in the UK

- All you need to know about starting and running a limited company

- Advantages of being a sole trader

- The biggest disadvantages of being a sole trader

- Employing someone as a sole trader

- How to extract profit from a limited company

- Assigning shares in a limited company