The first decision to make when considering starting a business is which structure to choose. To help you out, we discuss the advantages of being a limited company.

The vast majority of companies in the UK are either sole traders or limited companies. In fact, 93% of all businesses fall into one of these two categories, according to government figures.

So the chances are, if you want to start a business you will look at these two. And one of the best ways to decide is to look at the advantages and disadvantages. Drawing from our own experience, we look into what are the pros and cons of being a limited company.

The Pros And Cons Of A Limited Company At A Glance

| Benefits | Drawbacks |

|---|---|

| Limited liability | More complex to set up |

| More tax-efficient | Higher running costs |

| Higher levels of trust | More responsibilities and regulations |

| Better changes of investment | Company information on public register |

| Better protection of company name |

5 Top Advantages Of Being A Limited Company

It can be a daunting decision to make, whether to start your new venture as a sole trader or a limited company.

That’s why it’s good to look at the pros and cons and here are the benefits of running a limited company.

1. Liability

The company is responsible for its debts and not the people who run it, which means that as the owner, you won’t lose your home if the company runs into difficulties.

Of course this does not give you free reign to run up huge debts as there are laws that help to prevent the limited liability aspect of companies from being abused.

However, it does give you peace of mind that even if your venture fails, you will not be forced to lose your property or other possessions.

Starting A UK Business?

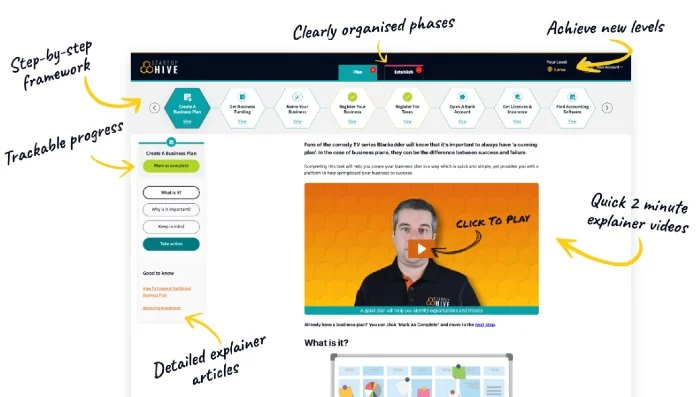

Get rid of the confusion and always know what to do next with Startup Hive, the step-by-step platform created by the Business4Beginners team.

- FREE Step-By-Step Platform

- FREE Bank Account

- FREE Bookkeeping Software

- FREE Email Platform

- FREE Domain Name

- Discounted Company Formation

- Plus Much, Much More!

Join today for 100% FREE access to the entire Plan & Establish phases, taking you from validating your business idea through to setting it up, getting your accounts sorted, and creating a website.

“Excellent guide to build your business”

“The perfect starting point”

“Incredibly simple and intuitive to use”

Startup Hive is your trusted companion as you look to turn all of your business dreams into reality. Join today for free.

—

2. Tax and Income

A limited company can pay its directors and shareholders a lower standard wage to provide the individual with a fixed wage. The rest is made up by paying a regular dividend, which is taxed at a much lower rate.

Usually this will mean you can pay less tax when running a limited company, and you have greater control over how much tax you pay. However, you should also take into account the corporation tax your business will need to pay.

Adding more weight to the limited company argument is the fact it is easier to claim other benefits such as a company car to further reduce your tax liabilities. For most people, therefore, a limited company will be more tax efficient than being, for example, a sole trader.

Recommended – Top-Rated Online Accountant:

3. Perception & Opinion

In any competitive environment, the perception of your business by your customers and clients is key. The type of company you are running will strongly affect the perception you want to give.

For example, a local housing window cleaner may prefer to be seen as a sole trader as this can be much more friendly and personable and may even increase the trust levels of customers.

However, a window cleaner who specializes in cleaning windows of large businesses may prefer the impression a limited company gives of them being a successful and professional operation.

So it will depend on what business you want to run and how you want to be perceived by your clients or customers.

4. Shareholders & Investments

If you are looking to gain investments or a loan for your business venture then undoubtedly a limited company has the edge.

For one thing, investors and banks will always be more keen to lend to a proper business than a sole trader, but due to the issuing of shares in limited companies, it’s much easier to make investment a more attractive option (since investors will gain a share of the profits).

Another consideration is that a limited company is much easier to sell or transfer to a new owner at a later date as they can just take over the issued shares. This also makes it easier to leave your business to a loved one in a last will of testament.

With these in mind, many people do find that forming a limited company is a more appealing option. In fact, many people who start off as a sole trader soon switch to a limited company once they begin to grow in size.

5. Protection For Your Company Name

When you register a limited company with Companies House, you first have to check if your chosen company name is still available. That’s because no two companies can have the same name.

This means, once you have registered your firm under a certain name, nobody can register theirs under the same name or one that sounds similar. That’s especially important if you are planning to build up a brand.

Of course, there is the option of registering a trademark, but this costs money, which you might not have when you first start out. So knowing that your company name is protected gives you peace of mind.

The 4 Biggest Disadvantages Of A Limited Company

Everything has its drawbacks and that’s also true for a limited company. And it’s important to understand these before you make the decision.

So now that you know what the advantages of being a limited company are let’s look at the disadvantages.

1. More Complex Set-Up Process

Setting up a limited company involves a process that, though not complicated, can feel a bit daunting. It involves providing a lot of information to Companies House, including names of directors, shareholder information, business address, etc.

And you have to pay a fee as well. It has to be said though, that the fees for registering a company here in the UK are among the lowest in the world. But if you start on a tight budget, that’s not much of a consolation.

You can use a company formation agency to do it all for you, which takes out the hassle from the process. And many of them have simple packages that won’t set you back too much.

2. Higher Running Costs

We have already said that setting up a limited company involves paying a fee to Companies House. But running costs are also higher than, for example, for a sole trader.

That’s mostly due to increased admin requirements, especially when it comes to accounting. Many limited companies need help with their accounts, which means hiring an accountant.

Accounting software can help to keep the costs down, as it makes light work of bookkeeping and reduces the amount you have to spend on it.

But even if you do your own bookkeeping, preparing your accounts can be complicated. And mistakes can be costly, as HMRC will fine you for mistakes as well as late filings.

So it’s wise to have an accountant by your side who can make sure that all is in order. Of course, this comes with extra costs.

EXCLUSIVE OFFERS – Save On Your Accountancy Costs

3. Reporting And Regulations

As a limited company, you have certain legal obligations, which other forms of businesses don’t have. These will increase the administrative burden and therefore the running costs.

The obligations you have to adhere to include:

- Keeping records about your company, such as its assets, directors, shareholders, company secretary, company shares, shareholder votes and decisions, information about people with significant control, company address, contact details, etc.

- Accounting records, including earning, outgoing, expenses, debts (owed to or by the company), PAYE records, VAT records, records of loans the company has taken on, etc.

As a limited company, you also have to file a Confirmation Statment every year. While this is quite simple and can be done online, there is a fee to pay for doing it.

And not doing is a criminal offence and can lead to legal proceedings, fines or the company being struck off the register.

You also have to file your company accounts with Companies House every year. Late filing will result in an automatic penalty. And again, it’s a criminal offence not to file them and the director is responsible to do so within the deadline.

As you can see, there are quite a few rules and regulations limited companies have to follow.

4. Company Information On Public Record

Another drawback of owning a limited company is that some of your details will be published on the Companies House website for everyone to see. So what’s on the public record?

- Name of the company, nature of business, business address (i.e. registered office address)

- Date of incorporation

- Status (active, dissolved, dormant)

- Details of company directors and people with significant control (name, nationality, month and year of birth, occupation, correspondence address)

- Correspondence address of company secretary

- Annual accounts and confirmation statements

As you can see there is quite a lot of information about the company and the directors public. That’s why it’s important to have an office address, because if you use your home address, this will be shown in the public register.

So even if you run your business from home, you want to have a different business address to keep your home address private. The good news is that you can use a formation agency to get a business address you can use and they will scan and forward any mail to you.

Recommended Address Service:

If you’re looking for an affordable address service for your business, we recommend 1st Formations.

They offer Registered Office, Service, and Business Address services either as part of a company formation package or as a standalone service.

Click here to visit their site

You Can Change Your Structure Later

Now that you know the disadvantages and advantages of being a limited company, you can make a decision with confidence.

While it’s important to choose the business structure that works best for your individual needs, it’s not set in stone once you’re set up. It’s possible to change from a sole trader to a limited company very easily.

It’s also possible to change the other way, but it’s much more complicated. As you have to dissolve your business and everything this entails and then register as a sole trader.

Also, one structure might be better for you now, but as your business grows, another works better. Many people start off as a sole trader and then change to a limited company.

If you are still not sure which one to go for, read our article about the difference between sole trader and limited company to get more clarity.

And if you still have more questions about both types, head to our FAQ page about limited companies and our FAQ page about sole trader.

Looking for more tips on running a business? Check out some of our other helpful articles:

- Is Hiring A Company Secretary The Right Thing For Small Businesses?

- Your Questions On The IR35 Rules In The UK Answered

- Starting A Business While Working Full-Time – What Are The Benefits And Drawbacks?

- All You Need To Know About Business Addresses In The UK

- The Benefits Of Changing From LLP To LTD In The UK

Top-Rated Accounting Software:

| Accounting Software | Cheapest Package | Ease Of Use | Our Rating | Review | Official Site |

|---|---|---|---|---|---|

| £33/mo | Excellent | 9.4 | Read Review | Visit Website |

| FREE | Outstanding | 9.3 | Read Review | Visit Website |

| £16/mo | Excellent | 9.3 | Read Review | Visit Website |