Businesses change and grow over time.

This is a good thing. But there are times when you need to look at the structure of your company and assess whether it’s still the best option for your new business.

If you’ve set up your business as a Limited Liability Partnership (LLP), and no longer want to share the ownership, or want reduced tax rates and greater liability protection as your profits have grown, you might want to consider converting your LLP to a LTD instead.

And that’s where we come in. In this guide, you’ll discover why converting an LLP to a LTD will benefit you and how you can complete this process.

LLP vs Ltd: What’s the difference?

Before we go into why, and how to convert your LLP to a UK limited company, we should clarify the differences between the two.

A limited company (LTD) is fully incorporated, making it its own legal entity within the UK. This means that legally, it itself enters into contracts, owns the property, and accumulates debt, not the individuals inside of it. An LTD also pays Corporation Tax rather than personal income, giving you better tax breaks.

An LLP (Limited Liability Partnership) is similar to an LTD in the fact that the assets of the company are separated from the personal assets of the individuals behind it.

Lost the buzz for your business?

Starting a business is exciting. Succeeding is rewarding. The bit between is hard, repetitive, and full of self-doubt.

The Lonely Middle Club (From Business4Beginners) helps you through it:

Get support and advice from other small business owners

Remove the self-doubt that’s holding your business back

Learn techniques and strategies to grow your business faster

Be inspired with our exclusive ‘swipe’ file and AI-powered tools

No pressure – work at YOUR pace, towards YOUR goals

—

However, the partners will share ownership and responsibility of the company together. Every year, the company will have to file annual accounts and compliance statements to the Companies House, but each partner will also have to complete individual tax returns and pay tax on their own personal share of the company.

Still not sure what is right for you? Discover the different types of company structures in the UK here.

What are the benefits of converting from LLP to a limited company?

At first glance, the difference between an LLP and a LTD might seem negligible. But having that extra liability protection and classification for your company as a legal entity opens up a world of benefits.

This includes:

1. Limited companies get allowable expenses

One of the biggest benefits of being a limited company is that you aren’t taxed on your personal income but instead pay a lower Corporation Tax. And on top of this, you’ll also be able to claim for allowable expenses reducing your overall tax bill.

Now, that doesn’t mean that you can write off every single receipt as a business expense. That would be cheating the system, and you’ll be facing an HMRC investigation faster than you can say ‘write off’.

Allowable expenses for limited companies are purchases that are ‘wholly, exclusively, and necessary’ for business purposes. And before you go thinking that spa day is essential for your business health, there are categories and guidelines as to what makes an allowable expense, including:

- Travel costs and everyday milage;

- Accountancy, legal or other professional fees;

- Bank or other financial charges;

- Business insurance policies;

- Charitable donations;

- Staff events or Christmas parties (limited to once a year, at max £150 a head);

- Equipment expenses, or office costs.

To find the full list, read our guide to allowable expenses for a limited company.

2. You can retain profits

In an LLP, any profits that are made have to be paid out to members – which are then subjected to Income Tax. If you’re turning over a big profit, this means that you could lose out quite a lot to taxes.

In contrast, a limited company doesn’t have to pay profits out via salaries. Profits can be kept and used to self-invest in the company for continued growth.

What’s more, LTDs can choose to pay their stakeholders via dividends, which has a lower rate of tax than personal income tax. This allows stakeholders to take home more of the profits without paying so much out to tax.

3. You can have sole ownership

The whole point of limited liability partnerships is that they are a partnership. You are always sharing ownership and responsibility of the company with a partner – and thus have to deal with shared decision-making and the red tape that comes with it.

With an LTD, you don’t need to share ownership and can have the company run by just one person, while the partner can be involved in a stakeholder capacity. This is great if one partner is thinking of leaving or retiring, as it means the company can continue to function without losing its protected liability.

If a partner leaves an LLP, it will be automatically converted into a sole tradership, which creates more vulnerabilities.

4. You create investment opportunities

To buy shares in an LLP, you generally have to become a member. This means that people cannot invest in your company without becoming involved and sharing some of the responsibility.

In contrast, people can invest in LTDs without becoming directors – making it easier to secure and obtain investment.

However, both an LLP and a LTD cannot list shares on the stock market. In order to list shares here, a private limited company (LTD) must be converted into a public limited company (PLC).

Recommended – Top-Rated Online Accountant:

5. Your company can be sold

If you’re thinking about selling your company for a profit, then converting an LLP to an LTD is an essential move. All takeovers, acquisitions, and general selling of companies are easier to complete as a limited company.

This is because you cannot just ‘buy’ an LLP. You have to purchase the goodwill and assets of the partnership and complete contractual obligations like transferring existing clients. It’s a longer and more drawn-out process, with more areas that could go wrong inside it.

If you’re looking for a simple sale, converting to an LTD will make the process a lot smoother.

Converting an LLP to a UK limited company

Right, let’s get down to the nitty-gritty details. How exactly do you convert an LLP to a UK limited company?

Although there’s no simple form you can fill out, the good news here is that the process isn’t as complicated as you might think.

In a nutshell, you need to create a limited company and transfer your current assets over. This means that you need to:

- Register a limited company at Companies House. If you’re unsure about this process, download our free formation guide here.

- Transfer assets and liabilities from the LLP to the newly formed business. We’d recommend doing this under a contract and seeking legal advice to make sure it’s done in the best possible way.

- Get members of the LLP to officially resign, then enter new contracts with the limited company. This is the time to implement sole ownership.

- Finally, dissolve the LLP.

If you want to carry out this process yourself, we’d recommend seeking advice from your solicitor and accountant to ensure that all assets are correctly transferred and you are not liable for any extra taxation.

Want someone to take care of it for you?

Company formation agents will be able to handle this entire process on your behalf, so you’re not stressing about the right types of forms to fill out or worrying about the minor details.

They’ll also provide you with extras like an official address if you need one, helping to protect your personal privacy if you don’t have a physical office location or if you work from home.

The best company formation agents to choose from

Ready to let someone take care of converting an LLP to a UK limited company on your behalf? We’ve tested and reviewed the best company formation agents around so you can go straight to the best.

Top-Rated Company Formation Agents

| Formation Agent | Cheapest Package | Add On Services | Our Rating | Review | Official Site |

|---|---|---|---|---|---|

| £12.99 | Excellent | 9.4 | Read Review | Visit Website |

| £11.99 | Excellent | 9.4 | Read Review | Visit Website |

| FREE | Average | 9.4 | Read Review | Visit Website |

1. 1st Formations

You’re in safe hands with 1st Formations. Rated as one of the leading online company formation agents in the UK, 1st Formations offer quick and easy packages depending on the type of organisation that you want to set up.

Their fees are transparent, with lots of additional extras to include every service that you need.

The only downside? It can feel a little like information overload at times as they explain the entire process. If you don’t care about the details, it’s best to gloss over this part.

Our Business4Beginners rating: 9.4/10.

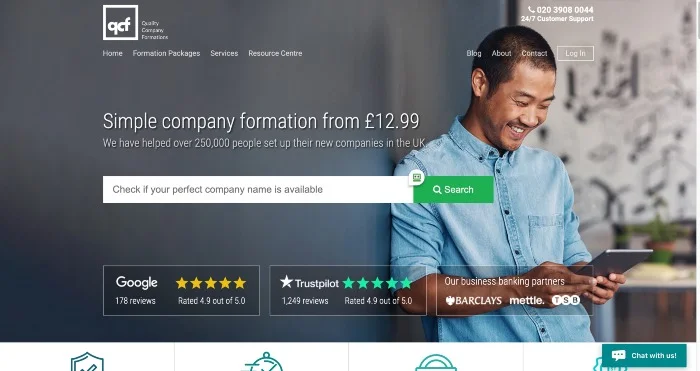

2. Quality Company Formations

Over the past 10 years, Quality Company Formations have helped over 250,000 set up their businesses in the UK. Boasting 99% positive reviews, this formation agency has some of the best customer support on offer when it comes to setting up your LTD.

In addition, Quality Company Formations also offer a free check of all client applications to ensure accuracy and some of the lowest prices on the market, making it the best value for money.

Our Business4Beginners rating: 9.4/10.

3. Rapid Formations

Rapid Formations promise a quick and easy formation service. And with companies formed within three to six hours, they deliver on their rapid name.

Rapid Formations are a great option if you want a simple and quick formation, and offer an online customer portal to talk to their team for any extra support. They offer a number of basic packages and advanced services for that outside of the UK – and LLP packages to suit.

Our Business4Beginners rating: 9.3/10.

Need any more business help?

At Business4Beginners, we’ve got the latest news, tips, and advice that you need to grow your business.