Do you have a business idea you want to jump into? Or are you ready to transition from being a sole trader to a limited company? If yes, you may be wondering: Can I set up a limited company on my own, or do I need the help of a solicitor?

In this guide, we’ll run through the ins and outs of setting up a limited company and the different avenues you can take, including doing it 100% DIY, enlisting the help of a formation agent or getting a solicitor to take care of the entire process for you.

Ready? Let’s get you a step closer to setting up your limited company.

Can I set up a limited company on my own?

Yes, you can set up a limited company on your own in the UK without the need to enlist a solicitor. If you want to set up a limited company as a single person, you only need to set yourself as the sole director and shareholder and submit the paperwork yourself to the Companies House.

The good news is that setting up a limited company by yourself is a lot easier than it used to be. But we will warn you, it still involves paperwork and ensuring you get the documents and process right – otherwise, you could encounter expensive setbacks and headaches.

The bigger question you should ask yourself though is: Do you want to set up a limited company on your own, or do you want help to make sure the process goes smoothly?

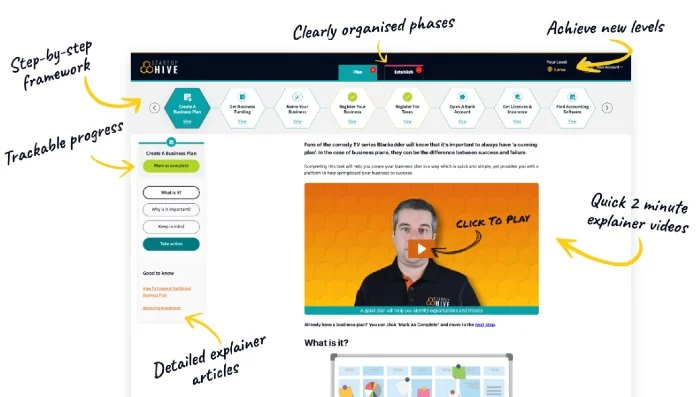

Starting A UK Business?

Get rid of the confusion and always know what to do next with Startup Hive, the step-by-step platform created by the Business4Beginners team.

- FREE Step-By-Step Platform

- FREE Company Formation

- FREE Bookkeeping Software

- FREE Bank Account

- FREE Domain Name

- FREE Email Platform

- Plus Much, Much More!

Join today for 100% FREE access to the entire Plan & Establish phases, taking you from validating your business idea through to setting it up, getting your accounts sorted, and creating a website.

“Excellent guide to build your business”

“The perfect starting point”

“Incredibly simple and intuitive to use”

Startup Hive is your trusted companion as you look to turn all of your business dreams into reality. Join today for free.

—

What are my options for setting up a limited company?

There are three general options for setting up a limited company.

Firstly, you could register your company by yourself directly to the Companies House. We’ll detail the exact process below, but this is your fully do-it-yourself option.

Secondly, you could use a company formation agent. These are companies that specialize in assisting in registering and forming limited companies. They make the process smooth and straightforward (for a limited fee) while also helping with extra services like business addresses.

And finally, you could use a professional solicitor or accountant to register your limited company on your behalf. This is the most expensive option but could be a good idea if you plan to set up with more than one shareholder or board member.

To help you decide which of these options is the best, we’ll dive into the pros and cons of each.

DIY: Setting up a limited company on your own

Forming a limited company by yourself isn’t as complicated as it used to be. In fact, you can now register your business online with Companies House in just a few minutes.

We’ve gone through the entire process in detail in this guide to forming a limited company, but let’s give you a brief overview of the five steps you’ll need to complete.

1. Pick a name

You can’t register a company without a name.

But before you get your heart set on a potential name, you need to run a few checks first. Your company name cannot already be in use, contain any offensive or sensitive words, or be too similar to an existing company name.

For example, if ‘Manchester Plumbing’ already exists, you cannot register ‘Manchester Plumbing Services’. It’s too similar and will confuse your future customers.

2. Decide on your registered office address

Every limited company needs a registered office address, which will become public information on the Companies House website. If you’re starting your business from home, you may not want to have this information shared so you need to think carefully about which address you register.

You can’t just pick an address out of nowhere though, as it needs to be used for official communications. If you want to protect your privacy, company formation agents or solicitors offer registered office services, giving you an address to use while forwarding all communication to you.

Recommended Address Service:

If you’re looking for an affordable address service for your business, we recommend 1st Formations.

They offer Registered Office, Service, and Business Address services either as part of a company formation package or as a standalone service.

Click here to visit their site

3. Appoint directors & shareholders

Limited companies need to have at least one director and shareholder. If it’s just you involved in the process, you can set yourself as the sole director and shareholder.

If you want to get more people involved, then you need to look more in-depth about who is listed as directors, who will be shareholders and the amount of shares that you all hold.

Pssst… you can find out more about assigning shares in a limited company in our guide here.

4. Create your official documents

To form your company, you need to provide a memorandum of association. This might sound scary – but it’s essentially a small document that details the company name and who the initial shareholders will be (which can just be you!). It also acts as confirmation of their intention to take shares.

This document is then attached to the articles of association which acts like a rulebook that binds all company members into following the procedures of the Companies Act.

You can find templates of both of these documents online.

5. Complete the application form

Now is the time for the moment of truth – submitting your application to Companies House and paying the relevant fee.

It can take a few days to complete. But once done, you will get a registration certificate, your registered company number & the official go-ahead to start trading!

Find out more information about the entire process with our free company formation guide here.

As you can see, the DIY process of forming a limited company isn’t too bad. It just involves a lot of manual paperwork. Plus, keeping track of the minute details can be hard to manage, especially if this is your first time completing the process.

It is due to this reason that many businesses prefer a formation agent or a solicitor to take care of the process, saving them from a ton of headaches.

Speaking of, let’s look at the process of using a formation agent or solicitor to see which is right for you.

Setting up a limited company using a formation agent

Company formation agents specialise in forming companies. They know the process in and out and are here to give you a helping hand and see to it that everything goes as quickly and smoothly as possible – for prices as low as £9.99.

In addition to handling documents, company formation agents also provide a number of extra services such as:

- Free website domains in your registered company name that let you get your website live at the same time you register your name.

- Business address services where agents provide you with registered business addresses to protect your privacy. They’ll also manage and forward all communication from this address to keep you compliant.

- Digital and printed documents in your new company name that are ready for use.

- VAT registration assistance.

- PAYE registration assistance.

- Full company secretary services that support your company’s day-to-day running. Communications and updates with the Companies House are also managed by them.

Whether you opt for the additional services or not, company formation agents are there to give you absolute peace of mind forming your company. To guarantee you are in good hands, we’ve reviewed the best company formation agents in the UK to find the best match for you.

Top-Rated Company Formation Agents

| Formation Agent | Cheapest Package | Add On Services | Our Rating | Review | Official Site |

|---|---|---|---|---|---|

| £12.99 | Excellent | 9.4 | Read Review | Visit Website |

| £11.99 | Excellent | 9.4 | Read Review | Visit Website |

| FREE | Average | 9.4 | Read Review | Visit Website |

Using a solicitor to form your limited company

Finally, you can use a professional solicitor to help you form your limited company. As the most expensive option, it’s generally not practical for beginners. But, it is most useful for those with complex situations, especially if you plan on setting up a company with multiple directors or shareholders.

Using solicitors to form your limited company can be invaluable as they can provide personalised legal advice to help guide you on your business journey.

Solicitors will also be able to draft shareholder agreements, which is a document that outlines your business model and expectations. This is done to protect your business further down the line and clear up any future disagreements that may happen with shareholders or partners.

In addition, solicitors can help you with other documents and licenses that you might need, as well as check leases and help you take out the right types of business insurance to protect your business.

Basically, using a solicitor to form your limited company will help you cover any and all legal areas of your business. Even if you don’t use them in the actual formation part, it can be useful to make sure you have one on hand if you need help with any other legal area.

Can I set up a limited company on my own from being a sole trader?

The answer is yes! A lot of businesses do start off this way, as being a sole trader gives more freedom and less red tape to get a business off the ground. Then, when it’s big enough, some people make the switch to a limited company to take advantage of the better protection and tax benefits that limited companies offer.

If you think this might be for you but aren’t sure when is the best time to form a limited company, take a look at our guide to picking the right moment to switch from a sole trader to a limited company.

Forming a limited company from a sole trader is relatively the same, with just a few extra steps to follow afterwards. This includes letting HM Revenue and Customs know about the change in your company structure.

You’ll also be de-registering as self-employed, as you’ll no longer submit a self-assessment tax return and pay Class 2 national insurance. Instead, you’ll be submitting full annual returns and paying all contributions through this and your PAYE wages.

If you have an accountant, you’ll also need to let them know of the changes. If you use accounting software—we always recommend it if you aren’t already—you need to make sure that you’re recording everything in line with the guidelines for a limited company and not a sole trader.

For the actual formation part, you have the same options as before:

- Do it yourself (which can be complex);

- Use a company formation agency (easy and cost-effective);

- Use a solicitor (expensive but covers all business areas).

Find out more information about going from a sole trader to a limited company here.

Important information to remember as a limited company director

Setting up a limited company is very exciting – but with that, it’s important to remember that being a director does come with certain responsibilities and obligations that you must follow. Boring, we know, but important.

This includes complying with:

Health and safety regulations

You have to guarantee that your business is safe, has carried out proper risk assessments, and has all the relevant procedures in place for the type of business that it is. For example, if you deal with hazardous waste, you need to comply with the hazardous waste regulations.

Tax obligations

You need to pay the correct amount of taxes on time, including national insurance, corporation tax, VAT, etc. Be sure you get all the paperwork in on time, as it will save you no end of hassle.

Employment law

You have to follow all the rules of being an employer, such as anti-discrimination laws, pension schemes and correct insurance levels.

Companies House obligations

You have to pass all relevant information and changes over to Companies House. Your annual returns must also be submitted as well.

Depending on the type of business and industry you’re in, there will be more specific obligations and rules that you have to follow. For example, if you provide services to other businesses, you must also ensure you know anti-money laundering regulations.

Here to help your limited company succeed

At Business4Beginners, our goal is to help you succeed. That’s why we’ve put together all this information on forming a limited company and have reviewed the best company formation agents in the UK to provide a cost-effective and easy way of forming your company.

But even after your business is formed, we’re here with all the tips, ideas and advice to help you succeed. Why not get started with some of our limited company guides, including:

- The Full Guide To Buying Property Through A Limited Company

- What Is A Company Secretary And Do You Need One As A UK Limited Company?

- How To Change A Limited Company Name

- How To Extract Profit From A Limited Company In The UK

- Assigning Shares in a Limited Company: A Beginners Guide

- Allowable Expenses For A Limited Company That You Can Claim

- What Are The Average Accountancy Costs For A Limited Company?

Good luck with your company formation!