When it comes to forming a UK limited company, there is no restriction on nationality or location of the director or shareholder of the company.

Non-resident company formations in the UK are 100% possible and an incredibly popular option. In fact, thousands of individuals across the globe form companies inside the UK each year.

The best news? It’s simpler and more cost-effective to complete a UK company formation as a non-resident than you might think. This guide will tell you how and answer any questions you might have about the process along the way.

What are the benefits of forming a UK limited company?

Forming a limited company in the UK comes with a range of benefits, even if you’re a non-resident. For example, a limited UK company gives you:

- Access to one of the world’s most profitable commercial markets without a work visa;

- Protection of your intellectual property and copyright;

- Less legal red tape when trading with UK businesses;

- Increased customer credibility as British customers are more likely to buy from, and trust, UK businesses than international ones.

And much more, especially as post-Brexit negotiations are ironed out and put into place.

Forming a UK company as a non-resident?

You’ll need to use a UK company formation that is experienced in providing company formations for non-residents.

We recommend 1st Formations as they offer a ‘Non-Residents Package’ that includes everything you need including UK business banking, 12-month cancellation protection, London registered addresses with International mail forwarding.

Click here to view the Non-Residents Package

What are the legal requirements to form a Limited Company in the UK?

To form a limited company in the UK, you need:

- A Registered Office address. This must be a UK address that can receive mail and communications and cannot be a P.O Box Address.

- At least 1 director and 1 shareholder (who can be the same person but in both instances must be over 16 years old).

Don’t worry though – you don’t need to buy a home or an office in the UK to serve as your Registered Home Address.

Starting A UK Business?

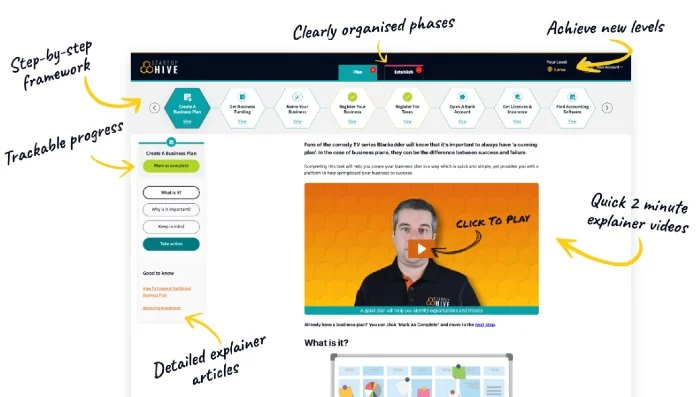

Get rid of the confusion and always know what to do next with Startup Hive, the step-by-step platform created by the Business4Beginners team.

- FREE Step-By-Step Platform

- FREE Company Formation

- FREE Bookkeeping Software

- FREE Bank Account

- FREE Domain Name

- FREE Email Platform

- Plus Much, Much More!

Join today for 100% FREE access to the entire Plan & Establish phases, taking you from validating your business idea through to setting it up, getting your accounts sorted, and creating a website.

“Excellent guide to build your business”

“The perfect starting point”

“Incredibly simple and intuitive to use”

Startup Hive is your trusted companion as you look to turn all of your business dreams into reality. Join today for free.

—

As we’ve explained in our guide to business addresses, you can buy a business address from a company formation agent to serve as your Registered Office and forward all your mail and official communications to you.

How long does the Company Approval process take in the UK?

Once you have submitted your online company formation form, Companies House requires approval of the details of your business. This may take up to 24 hours, but is usually quicker.

What happens after your company is approved by Companies House?

Once your limited company is approved by the Companies House, you will receive an email confirmation of this formation, as well as:

- A company Certificate;

- A Share certificate;

- Memorandum of Association and Articles of Association for your company.

Once this is done, you just need to make sure that you abide by the regulations and laws of UK limited companies. For more information on this, see our guide to the responsibilities of limited company directors.

Does every company in the UK have to register for VAT?

No, not every company needs to register for VAT in the UK unless you expect your annual turnover will exceed £85,000. Your VAT-taxable turnover is the total of everything your company sells that isn’t VAT exempt, not how much profit you make from those sales.

There may also be some cases where you will need to register for VAT, depending on the types of goods or services you sell and where you sell them. For more clarification, you may want to consider speaking to a formation agent or accountant.

However, you can voluntarily register for VAT. This can provide your business with a number of benefits, including:

- Being eligible to recover VAT on the purchases of your goods and services.

- This recover will include any VAT you have been charged on purchases 3 years before you registered for VAT, provided the purchases are still in hand and you can provide evidence.

- Recover VAT on services that you paid for before you started a limited company. You can recover VAT on services that you paid for up to six months before you registered for VAT (services must be for business purposes and you must have an invoice).

In addition, being VAT registered can also give your company the appearance of being a larger and well established corporation, particularly to other VAT registered businesses and professional clients, increasing your reputation.

However, if you choose to register for VAT, you will have to keep careful VAT records and send VAT returns on a quarterly basis.

In addition,

- Charging VAT may decrease the desirability to potential customers, especially if they are not VAT registered themselves.

- If your output tax exceeds input tax, you’ll be required to pay the difference back to HMRC, which could cause cash flow issues.

The good news is that you don’t need to register for VAT to create a limited company, so these decisions can be made at a later date.

Do you need to register for UK Corporation Tax?

Yes, if you form a limited company in the UK you have to be registered for Corporation Tax with HMRC. This must be completed no later than three months after starting to do business or receiving any type of taxable income.

HMRC will use the information you provide during registration to work out your Corporation Tax ‘accounting period.’ This determines your deadlines for filing Company Tax Returns and paying any Corporation Tax you owe.

A Company Tax Return is usually due 12 months after the end of the accounting period it covers. If you owe corporation tax, you have nine months after the end of the accounting period to pay it.

Do you need a UK bank account to register a limited company?

No, you don’t need a UK bank account to register a limited company in the UK. All you need is a Registered Office address and at least 1 director and 1 shareholder (who can be the same person).

However, having a UK bank account may be useful for some companies when trading in the UK, rather than dealing with the hassle of making overseas transactions.

Can you get a UK bank account with a limited company?

Although it’s easy to complete a UK company formation as a non-resident, getting a UK bank account is another, more difficult matter.

Sadly, most banks won’t entertain an application unless you have UK residency due to concerns over fraud. Some banks also don’t offer accounts to non-residents due to the additional administration costs. And no, they won’t accept a Registered Office address on a bank application.

To open a UK bank account, you may need to do a face-to-face interview and submit suitable identification, such as a passport or UK driver’s licence. The following banks have different conditions regarding non-nationals opening business bank accounts.

HSBC

Non-resident directors can open a company account, but the owners must visit the UK to present a photographic ID and proof of address, and sign a bank mandate.

Lloyds Bank

Lloyds offers business bank accounts for non-residents, but only if one director lives in the UK. This UK resident has to visit the bank in person.

Barclays

There are no restrictions for opening international bank accounts with Barclays. However, international accounts must begin from their Isle of Man branch. You still have the same benefits as onshore account holders, but your account will be classified as offshore. Barclays does require that you put £25,000 into the account within the first month of opening it. They may however waive the requirement if you include a covering letter with the application.

If you use a company formation agency to create your UK limited company, they may also be able to offer you advice or help you get a UK bank account as part of the process.

What other responsibilities do I have as a UK limited company?

Your company must deliver a confirmation statement at least once a year, even if it is dormant or non-trading. The confirmation statement has replaced the annual statement in the UK, and is due every 12 months and has to be filed to the Companies House.

You can file a confirmation statement up to 14 days after the due date, however, it’s a criminal offence for failure to file the confirmation statement within 14 days of the end of the review period. If you don’t do this, the company and its directors may be prosecuted.

Limited companies also need to provide financial statements for the past accounting year. If your company is dormant, you have to file dormant company accounts.

Statutory accounts must include:

- a ‘balance sheet’, which shows the value of everything the company owns, owes and is owed on the last day of the financial year;

- a ‘profit and loss account’, which shows the company’s sales, running costs and the profit or loss it has made over the financial year;

- notes about the accounts (if applicable);

- a director’s report.

You might have to include an auditor’s report depending on the size of your company. It is necessary for the balance sheet to have the name and signature of a director on it.

First accounts are due 21 months after a company incorporation date and then all subsequent accounts have up to 9 months plus 1 day from your Accounting Reference Date. If you file it late, Companies House can levy a penalty.

If you fail to file your accounts, the Companies House can strike your company from the Register, freezing all of your assets.

How to complete your UK company formation as a non-resident

The easiest way to complete your UK company formation as a non-resident is by enlisting the help of a company formation agency.

A company formation agent is a professional agency that assists in the registration of companies at Companies House. Basically, company formation agents are agencies that set up and register companies, removing any red tape, confusion, and hassle. As part of this service, company formation agencies can also provide UK Registered Office addresses for your business.

In addition, company formation agents are there to provide specialist advice and support throughout the application process and beyond – including information and support applying for a UK bank account.

To make sure that you’re getting the best possible advice, help and deal on setting up your business, we’ve tried, tested and reviewed the best company formation agents on the market.

Top-Rated Company Formation Agents

| Formation Agent | Cheapest Package | Add On Services | Our Rating | Review | Official Site |

|---|---|---|---|---|---|

| £12.99 | Excellent | 9.4 | Read Review | Visit Website |

| £11.99 | Excellent | 9.4 | Read Review | Visit Website |

| FREE | Average | 9.4 | Read Review | Visit Website |

Want more advice on setting up your new business?

We’ve got your new business covered.

When it comes to running your own business, we’ve got all the advice, tips and news you’ll need at Business4Beginners.