As a business owner, keeping your books in order is critical if you are to ensure you manage your cashflow, meet your legal requirements, and pay the correct amount of tax.

Yet, 61% of new business owners say they intend on avoiding using an accountant.

That’s according to data we have collected here at Business4Beginners over the past 5 months.

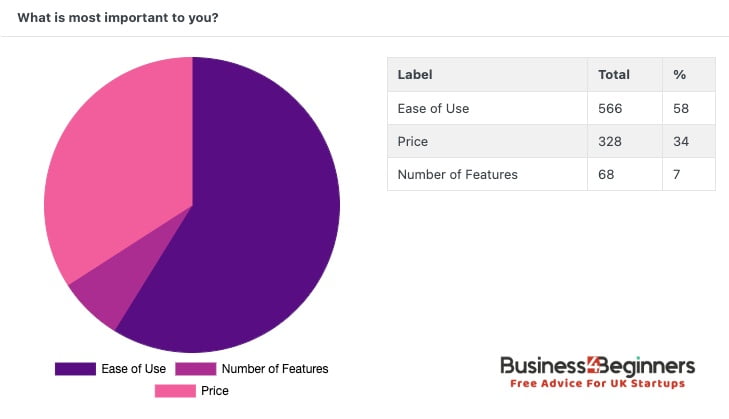

By asking those showing an interest in using accounting software, we were able to establish that the majority wanted to avoid the need for an accountant and, as a result, 58% valued ‘Ease of Use’ as their most desirable software feature.

Only 28% Intend On Using An Accountant To File Annual Accounts

Out of 962 people surveyed, 593 (61% )said that they themselves, or someone else in their business, would be filing their annual accounts. Only 276 (28%) said they intended on using an accountant, while just 93 (9%) were still unsure.

This perhaps reflects the growing costs of starting and establishing a business, particularly with current issues around the economy, food and energy prices, and other business challenges.

It would appear many entrepeneurs are looking for ways to save money in their formative years and the services of an accountant are considered an acceptable sacrifice.

Given that as many as 1 in 5 businesses fail every year, it’s hardly surprising people are looking to keep costs as low as possible.

It may also reflect the growing confidence business owners have about dealing with their own accounts. This has been driven by a rise in accessible bookkeeping and tax information as well as the advance of accounting software that has simplified the process.

Comments from the founder of Business4Beginners, Paul Bryant:

“It perhaps isn’t surprising that many business owners are looking for ways to cut costs and accountancy fees appear to be a sensible place to start. However, before making a decision to forgo the services of an accountant, entrepeneurs would be wise to consider the opportunity cost.

A good accountant will actually save you money by helping you take advantage of the many tax benefits that are designed to help small businesses.

“Plus, running a business takes a lot of hard work and dedication. The fewer distractions, the more likely a founder is to make a success of their idea. Therefore, outsourcing the heavy lifting of accounting can actually be a shrewd investment that speeds up the success of a company.”

58% Say ‘Ease Of Use’ Is Most Important In An Accounting Software

It may not be surprising given the number of respondents who are looking to get by without an accountants help, but 58% thought that ‘ease of use’ was the most important feature in an accounting software.

That’s compared to 34% that felt that price was the most important factor. Only 7% felt that features were the most important, suggesting that software that focuses on usability at a reasonable price will be more appealing to users than those that add complexity through lots of features.

Comments from the founder of Business4Beginners, Paul Bryant:

“We see a lot of accounting software push their list of impressive features, yet our research suggests this may put many people off if they percieve the software to be harder to use as a result.

“Accounting software providers should focus on simplicity as much as possible. Sure, they can talk about features, but the emphasis should be on how each feature makes life easier for entrepeneurs.”

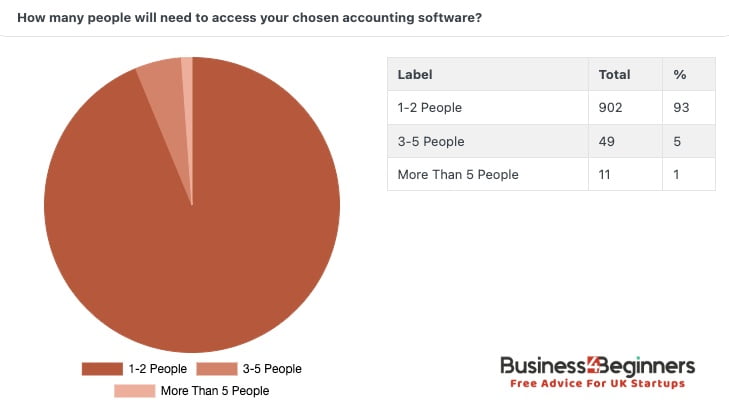

93% Say Only 1 Or 2 People Will Access Their Accounting Software

Only 6% of respondents say their accounting software will be used by 3 or more people. The remainder (93%) say it will only be used by 1-2 people.

Given that 75% of UK businesses do not employ anyone other than the owners, it perhaps isn’t surprising that so many businesses say their accounting software will be used by so few.

This again strengthens the message that accounting software shouldn’t be over-complicated.

Comment from the founder of Business4Beginners, Paul Bryant:

“The results here help demonstrate just how small many businesses are in the UK. Even when a business is considering doing accounting themselves, they still only have 1 or 2 people keeping their books and returns in order.”

About The Survey

The survey was conducted January-May 2022. Of the 968 respondents, 670 (69%) considered themsleves sole traders, while 242 (25%) were trading as limited companies. 50 people (5%) stated they had another type of company structure.

Many of those who took part were providing services to clients with 501 (52% stating they provided billable services to clients a lot. 203 (21%) stated they ‘sometimes’ provided billable services to clients, while 258 (26%) said they never do.

All respondents were recruited via the Business4Beginners website after showing an active interest in using off the shelf accounting software for their business.

Images supporting this press release can be downloaded here.