Starting a business is a risky venture.

According to the latest stats, almost 1 in 5 businesses fail in the UK every year. Even worse, 60% of new businesses will fail in the first 3 years, making the market even more perilous for new businesses.

Now, some of this is down to common mistakes, which we’ll help you avoid in our guide to why new businesses fail in the UK. But regardless of the reason, that risk is still over your head.

To help mitigate that risk, a lot of people start their business while still working at their current job. Although you have less time on your hands, it’s a great way to hold onto your steady income while you get things off the ground and making a profit.

But working a full job and starting a business is no easy task. So to help you out, our team have rounded up the top tips for starting a business while employed. It’s something we even used ourselves while getting our own businesses out there.

Can you start your own business while being employed?

Absolutely! There’s nothing stopping you from starting and running your own business while you’re employed.

However, although there’s nothing legally stopping you from doing this, there are a few restrictions tor disclosures that you may have to follow depending on what’s in your employment contract that you could be in breach of by starting your own business.

Generally, these clauses cover one of the following events, however, some contracts may have additional clauses that will affect your side business. Before you start, make sure to read through your contract and get legal advice if you’re ever unsure.

Intellectual property

If you develop the intellectual property as part of your full-time job, your business may have a conflict of interest disclosure that forbids you to develop similar technologies based on the knowledge and experience that you’ve picked up.

For example, if you worked for Dyson and had background knowledge about how their new hoover worked, you couldn’t then develop your own hoover business using the same technology.

Even if the intellectual property in question was your idea or hard work, you are prevented from using it for yourself because it belongs to the company.

It does suck, but if you are passionate about something that you want to turn into a business, develop it outside of work.

Alternatively, if you create something that’s different from your current employer, BUT create it using company resources or time, then this becomes the intellectual property of your employer instead.

The moral of the story here is to make sure your side business doesn’t copy your current employer – and you need to triple-check that you don’t work in business time or using their equipment.

Non-compete clauses

Some companies have non compete clauses that prevent employees from leaving to join a direct competitor. So if you worked for Coca Cola, for instance, you couldn’t then immediately get a job at Pepsi and leak all your secrets.

Non-compete clauses don’t just stop you from working for a competitor, but also prevent you from creating a business that will directly compete with your current employer. So if you worked for Coca Cola, you would be forbidden to get a job at Pepsi or to create your own line of carbonated soft drinks.

Non-compete clauses often have time limits on them, so if you really had your heart set on making a business that does the same thing, you may have to find another job while you wait the limit out.

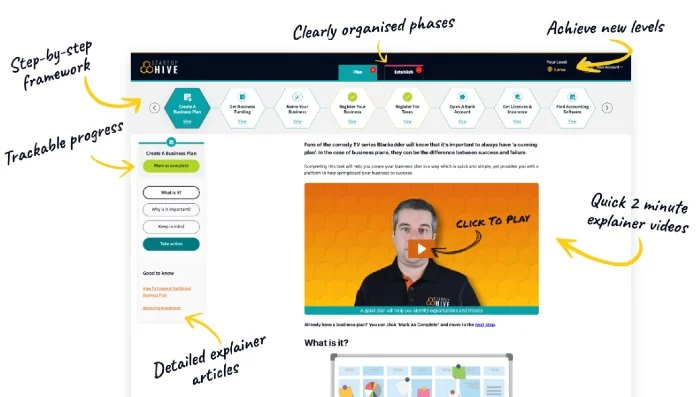

Starting A UK Business?

Get rid of the confusion and always know what to do next with Startup Hive, the step-by-step platform created by the Business4Beginners team.

- FREE Step-By-Step Platform

- FREE Company Formation

- FREE Bookkeeping Software

- FREE Bank Account

- FREE Domain Name

- FREE Email Platform

- Plus Much, Much More!

Join today for 100% FREE access to the entire Plan & Establish phases, taking you from validating your business idea through to setting it up, getting your accounts sorted, and creating a website.

“Excellent guide to build your business”

“The perfect starting point”

“Incredibly simple and intuitive to use”

Startup Hive is your trusted companion as you look to turn all of your business dreams into reality. Join today for free.

—

What are the benefits of starting a business while employed?

Starting a business while employed is a great idea for those that are just getting going, or have no experience in being self-employed before.

Retaining your current job allowed you to be able to rely on a steady income while you test how successful your new business will be. It will also help you cover any unexpected costs while you work out the financial side of things, and give you time to really assess how much money you’ll need to earn in your business in order to make the switch.

Starting a business while employed also gives you time to really figure things out. If you leave your current position to start a business, you’re on a ticking clock to get everything set up and making an income as quickly as possible.

If you’re still employed, you don’t have that financial or time pressure. That means you can take your business at your own pace, and dedicate as much time as you need to really plan and figuring things out before you turn it into a full-time operation.

Can you get fired for starting your own business?

You can’t get fired just for starting your own business. However, you can be fired or sued if you start a business that’s in breach of your employment contract.

As mentioned earlier, there are two common employment disclosures that you have to look out for here.

- The first is intellectual property, which forbids you from using ideas, technology or creatives from your current employer and using them for your own business. Even if they were ‘your ideas’, you’ll be prevented from using anything that you developed or researched using company time or resources.

- The second is the non-competitor clause, which prevents you from working for or being in direct competition with your employer. If you set up a direct competitor to your employer, they can dismiss you immediately to protect their own knowledge, client base and secrets. What’s more, they can sue you for any lost income and clients that you would have picked up from the business.

Before you start your own business, make sure you read your employment contract and protect yourself from dismissal or legal action by any breaches – accidental or otherwise.

Should I tell my current boss about my business?

This is a tricky one.

There’s no legal obligation to tell your current boss about your business. And frankly, some people would argue that you should keep it quiet as if your employer thinks that your performance is dropping because of the time you’re putting into your new endeavour, they might start looking to replace you.

Alternatively, if you’re just testing the waters for your business, it could make you seem disinterested in your current role, possibly causing your boss to overlook you for promotions or certain work.

However, there are benefits to telling your employer about your new business.

Your employer could be a great support for your side business and potentially look to partner with you in the future. In some cases, your boss may even want to help out by becoming a funder or becoming a stakeholder in the company.

Telling your boss about your business could also help you work out flexible hours or even going part-time if you need more time to focus on your business as well.

Ultimately, it depends on your current situation and the relationship that you have with your employers.

How to calculate tax when you’re employed and run a business

This is an important one. Generally speaking, if you are starting a business while employed, you will be classed as self-employed and employed at the same time.

That sounds confusing, so let us simplify.

Your current tax from your employment will not change. You’ll still pay the same amount of tax and NI as normal, and this will be deducted from your wage.

However, as soon as you start receiving income from your new business, you need to also register as self-employed with the HMRC and complete an annual self-assessment tax return each year. As part of this registration, you’ll also need to pay:

- Class 4 National Insurance, which will be included in your taxes when you complete your self-assessment tax form.

- Class 2 National Insurance, which is a flat-rate contribution that is calculated on a weekly basis that you will have to pay in one lump sum.

However, if you’re just starting out and your profits are under the Small Profit Threshold for the tax year, you can apply to be exempt from paying Class 2 National Insurance. This won’t affect your State Pension if you’re still paying your normal Class 1 National Insurance on your regular wages.

Remember, as soon as your business starts to receive income, you need to register with the HMRC as soon as you start making an income.

Failure to do so will result in fines and potential legal action against your newfound business.

Recommended – Top-Rated Online Accountant:

Depending on what products your business sells or the services it offers, you might also want to consider registering for VAT. However, this won’t be required for most new startups, as VAT registration is only compulsory if your annual turnover exceeds more than £85,000. Find out more about VAT and why you might volunteer for VAT in this guide.

The top tips for starting a business while employed

Now the gritty questions are out of the way, let’s dive into the best tips for starting a business while employed.

1. Start small

Staring a new business is an exciting opportunity! While you’re first diving into it, you might be full of big ideas, plans and passions ready to funnel into your new business.

But, that’s not a good idea.

Putting too much in at the beginning while still navigating your current job is a sure-fire way to get burnt out and turn your bright spark into an extinguished flame. Although you’re full of good intentions, you need to keep them bottled up for a tiny bit while you get an achievable, small step plan in place to carry on your business in the long term.

Think small steps and what you can achieve in a few hours a week, rather than pulling all-nighters to get your grand idea out of the box while you’re still employed.

2. Save your side income for your business

One of the biggest benefits of starting a business while employed is that you can hold onto your regular income and protect yourself in case your business doesn’t work – or doesn’t make enough profit.

So when you start getting an income from your business, you’ll end up with more money than you’ve been used to. Now, instead of splurging out and treating yourself, it’s a good idea to save all the income from your business and reinvest it into the company.

Your normal wages will allow you to live life as normal, while this extra income will help grow and build your business to the point where you can join it full time.

EXCLUSIVE OFFERS – Save On Your Accountancy Costs

3. Remember your work/life balance

With a full-time job and starting a new business, you’re going to be juggling a lot in your schedule.

But, you do need to remember to fit life into this work/work/life balance. Not taking a break from your business just leads to increased stress, burn out and resentment for what you are building. No human was designed to work 24/7, so ignore what those CEO’s tell you about ‘the hustle’ and make sure you actually have time to breathe, relax and get a life.

Taking breaks from your business will also help you with creativity, spark new ideas and keep the passion for it alive.

4. Create your ‘big switch’ plan

When starting a business while employed, there’s one big goal in mind. To get your business to a point where you can run it full time and leave your current position.

So one of the best things you can do is outline your ‘switch goals’, making it clear at what point you’ll hand in your notice and fully embrace the world of self-employment. This could include:

- Hitting a certain amount of income that matches your current wage;

- Reaching a profit goal;

- Hitting a certain number of clients and predicted income.

Whatever it is, make it certain – and don’t just pick a date out of the air. Although it’s good to set rough deadlines, you never know what’s going to change when you’re balancing two jobs.

5. Know your legal obligations

As we mentioned earlier, as soon as your business starts to make a profit, you need to register for self-assessment with the HMRC. In addition to this, it’s also a good place to mention your contractual obligations with your current employer.

Make sure you read your employment contract and check for ANY clauses or disclosures that you need to be aware of. If you’re ever in doubt, seek legal advice.

When you register your business, you can also find out about the legal obligations of a sole trader here.

6. Make your business legit!

While you’re still working out the details, you don’t need to register your company. But once you’re ready to start trading, it’s always best to go legit and get your company registered.

This won’t just prepare you for the future, but also give you a more legitimate and professional appearance to start getting those sales in.

When you’re starting out, you’ll want to decide between registering as a sole trader, or forming a limited company. If you’re not sure which one to choose, read our guide on becoming a sole trader or a limited company.

When you’re ready to go legit, you might also want to take advantage of a formation agent. They’ll handle all the paperwork and minor details for your company and can even provide a company address for you to use to protect your privacy. It’s perfect if you haven’t got much time spare while you’re still employed!

Find the formation agent for your business with our top picks and reviews of the best company formation agents in the UK.

7. Set a schedule

Just like you have set employment hours, you will want to set a dedicated time to focus on your new business. Setting dedicated time will also help with your work-life balance, and help you better plan what you need to do with your time.

8. Delegate, automate and get help

No one can do everything, and when you’re starting a business while employed, time is of the essence.

Think about everything that is on your plate, and look for ways to delegate, automate and get help (hired or otherwise) wherever possible! That way, you can focus on the tasks that only you can complete.

If you’re not sure where to start, why not check out our accounting software reviews which can automate the time you spend on your books and working out your finances.

Want more business advice?

We’re here for you. No matter what you need, Business4Beginners has all the tips, advice and ideas to help make your business thrive.