![]() Rated #7 Best UK Accounting Software

Rated #7 Best UK Accounting Software![]() Rated #4 Best UK Online Accountant

Rated #4 Best UK Online Accountant

PROS:

- Free software available with no requirement to use their accounting services

- Wide selection of paid packages with extra features and services provided

- A good way to blend the convenience of keeping your own books but with expert help on hand when you need it

CONS:

- You might need to arrange a phone consultation to take advantage of all the benefits they offer

- The more advanced packages can get quite pricey

- Generally positive customer reviews but there are a few negative ones around

As a freelancer, sole trader, small business owner, or start-up, you may be keen to get help with your accounting.

Dealing with the accounting side of your business can be complex and time-consuming, particularly if you do not have a head for numbers. However, there are specialist solutions you can turn to including Crunch accounting software and packages.

In this Crunch accounting review, we take a closer look at what you can get and how you can benefit. You can learn more about the features and services available from Crunch, and this means that you can make a more informed choice.

Recommended – Top-Rated Online Accountant:

At a Glance

We’ll start our Crunch accounting review with an quick summary to help you see whether this is the right solution for you.

In short, Crunch accounting is an online accountancy firm that offers a free accounting software to help you get your books in order. While there are packages that include accountancy services such as VAT and tax returns, there’s no obligation to use Crunch for anything more than keeping your books in order.

That means you could use Crunch for your day-to-day bookkeeping, but hire another accountant to do your returns.

As for the software itself, it has plenty of nice features and the free version is even suitable for limited companies as well as sole traders.

The number of reviews the company has is quite impressive, though we must admit they are a bit of a mixed bag. We’ll look at this in more detail later in this Crunch accounting review. For now, let’s dive deeper into the features on offer.

Which Accounting Software Is Right For You?

Answer 5 multiple choice questions to get a personal recommendation:

What Features Does Crunch Accounting Support?

One thing to bear in mind with Crunch is that you can opt for free software to help you deal with financial matters and save yourself time and stress. If you prefer, or when you are ready, you can then go for one of the available packages.

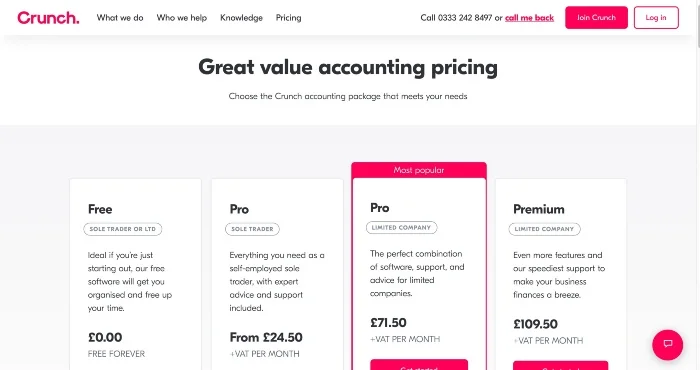

There are several different packages you can choose from based on your needs and circumstances. In addition to the free software option, you can choose from:

- Pro package for sole traders

- Pro package for limited companies

- Premium package for limited companies

The premium package is the one that offers the widest range of features, including everything in the other packages along with a range of extras. So, in this Crunch review, we will look at the features and services included in the premium plan.

Simple Accounting Software

One of the benefits that you get with all the paid plans from Crunch is simple accounting software. The software is easy to use, efficient, and can make life much easier for both sole traders and business owners.

You can do all sorts of things with the software from filing your tax returns to tracking invoices and recording payments.

Unlimited Support

Another benefit of the paid plans is unlimited support via email and phone. This means that you can get assistance from experts whenever you need it, so you do not have to struggle to find answers or make mistakes when it comes to your business finances.

There are accountants and client managers ready to help you, and you can look forward to fast and reliable responses.

Year-End Accounts

Dealing with year-end accounts can be very stressful and hectic for some people. With Crunch accounting packages, you can benefit from the help of experts who will ensure that your accounts are prepared and filed properly.

All the work is done by expert accountants, and everything from preparation to filing and submission is covered. All you need to do is provide the information requested.

Filing VAT and Corporation Taxes

Another thing that can cause a lot of stress for many people is filing VAT and corporation taxes. This can end up being very time-consuming and frustrating, particularly when you are limited for time.

Our Crunch Accounting review found that with the paid packages from Crunch, you can look forward to VAT and corporation taxes being prepared, checked, and filed on your behalf by experts.

Company Formation and Registration

You can also look forward to having assistance with forming your limited company and making sure it is properly registered for all relevant taxes.

With the comprehensive package for limited companies, you can also benefit from the provider acting as the registered address for your business.

Company Filings

With the comprehensive paid package, you can get help with all aspects of company filings, which can save you time, stress, and resources. This includes VAT and corporation tax filings as mentioned previously.

All annual accounts will be prepared and filed as required, and for premium plan holders, everything is prepared and made available to check within a specified timeframe.

Banking Services

There are various banking services that come as part of the paid plans. This includes the ability to link your business bank account with your Crunch account. The software is compatible with most of the major banks in the UK, and this makes account reconciliation far easier.

Tracking Apps

Another thing you can benefit from is access to a range of financial tracking apps that can help you on a day-to-day basis with your business accounting. This includes mileage tracking apps for your business as well as receipt scanning apps to help track and monitor spending.

Discounts on Services

In addition to the other features and benefits mentioned so far in our Crunch accounting review, you can also enjoy the chance to save money.

This is because you can get access to special and exclusive discounts on services such as mortgage services and business insurance. So, you can benefit from reducing your outgoings on specified services.

Self-Assessment

With the premium plan, you can look forward to a Self-Assessment for one or two company directors. The accounting experts will carry out a range of checks to ensure everything is done by the book, and this means that you can ensure you pay the right amount of tax and claim the maximum allowances you are entitled to.

Annual Accounts Health Check

If you are keen to improve the financial efficiency and growth of your company, the team at Crunch offers an annual accounts health check to assist you in achieving this goal.

The check is carried out annually, and it includes advice and guidance to help you with the financial performance of your business as well as update you on regulatory changes.

IR35 Solutions

The premium plan also comes with a range of IR35 solutions for those who need them. You can learn more about IR35 from the accountancy experts at Crunch, and you can then look at the options available with their switchable service.

These are some of the key features and services that come with paid plans from Crunch. You should always ensure you check what comes with each of the plans to help you to decide which one is ideal for your needs.

Remember, there are plans that are designed for sole traders and freelancers as well as those with limited companies. So, make sure you look at the features of the plan that fits in with your circumstances.

Fees

As we mentioned earlier in this Crunch accounting review, there is a completely free package you can choose if this suits your needs. This includes free bookkeeping software to help you with your business finances and save you time. If you then need to upgrade, there are a few options, some of which are cheaper than others.

The paid packages all come with a monthly fee plus VAT, and the cost depending on the plan you feel is most suitable for your needs.

You do get a lot for your money, particularly with the premium plan. However, the cost of the more comprehensive plans is significantly higher than the more basic ones. Also, if you add on additional services and costs, the overall price can spiral.

In order to get the best value, make sure you look at exactly what each paid plan offers and who it caters to. You can then ensure you choose the one that is best suited to your needs and fits in with your budget.

Crunch Accounting Reviews From Customers:

I have used Crunch for over 5 years and always found them to be professional and speedy in their responses. I feel I can approach them about any company matter however small.

5-Star review from Alex M via Trustpilot

Absolutely loving my Crunch experience. It’s my first time as a freelancer and the Crunch platform is incredibly easy and straight forward to use. Not to mention a beautiful User Interface.

5-Star review from Jamie Tomkins via Trustpilot

My client manager, Dan Page, has also been incredibly helpful (and patient) in getting me up to speed and helping me understand each process—thank you Dan!

Crunch Accounting TV Advert

The Advantages

As with any other service you choose for your business, it is important to consider the advantages and disadvantages of Crunch before you make up your mind.

Some of the advantages you can benefit from with Crunch include:

- You have the option of free software

- There are several packages you can choose from

- You get a great level of service

- Reviews of the provider and packages are excellent

- There is an extensive range of services with premium plans

- It makes dealing with finances far easier

- The software is very easy to use

Signing up for one of these packages lets you benefit from the expertise and services of an accountant without hiring your own accountant.

The Disadvantages

Of course, you also need to consider the downside of Crunch so you can weigh up the pros and cons. Some of the disadvantages are:

- Costs can spiral with comprehensive plans and add-ons

- You need to arrange a phone consultation to get started

- Mostly positive customer reviews but there are some negative ones

There are not many disadvantages that come with Crunch packages, which makes this a pretty popular solution with both sole traders and start-ups/small business owners.

Crunch Accounting Review – Summary

To summarise our Crunch Accounting review… accounting plans and packages with Crunch are excellent for individuals and businesses that need expert services coupled with convenience.

The choice of plans makes it easy to find one that is perfectly suited to your needs and circumstances. In addition, you can look forward to easy access to support from experienced accountants and support staff.

The software that comes with the packages is very easy to use, and this takes much of the stress out of accounting. You can get answers and assistance with ease, and you can get help with all aspects of company filings.

This not only reduces the stress of having to file taxes and returns but also saves you a huge amount of time. Also, it ensures that everything is done correctly, which can save you a lot of headaches in the future!

For those who do not have an in-house accountant and do not want to go to the expense of getting one, Crunch accountancy plans are a great alternative. The excellent ratings from those who have left a Crunch accounting review online are a testament to the service levels and effectiveness of the plans provided by Crunch.

Top-Rated Accounting Software:

| Accounting Software | Cheapest Package | Ease Of Use | Our Rating | Review | Official Site |

|---|---|---|---|---|---|

| £19/mo | Excellent | 9.4 | Read Review | Visit Website |

| FREE | Outstanding | 9.3 | Read Review | Visit Website |

| £12/mo | Excellent | 9.3 | Read Review | Visit Website |